ACH File Export

ACH Payments Your Way—Export NACHA Files Directly to Your Bank.

Streamline vendor payments with Checkrun’s new ACH File Export feature. Create NACHA-compliant files, maintain control over your banking relationships, and process secure electronic payments from your own bank account.

What Is ACH File Export?

Checkrun’s ACH File Export feature lets you generate NACHA-compliant files directly within your Checkrun dashboard. These files are ready to upload to any U.S. bank that accepts ACH batches—giving you the flexibility and control to pay vendors electronically without third-party processors or extra fees.

Whether you bank with Wells Fargo, Bank of America, or a regional credit union, Checkrun generates the ACH files you need—automatically formatted to your bank’s specifications.

How ACH File Export Works

1

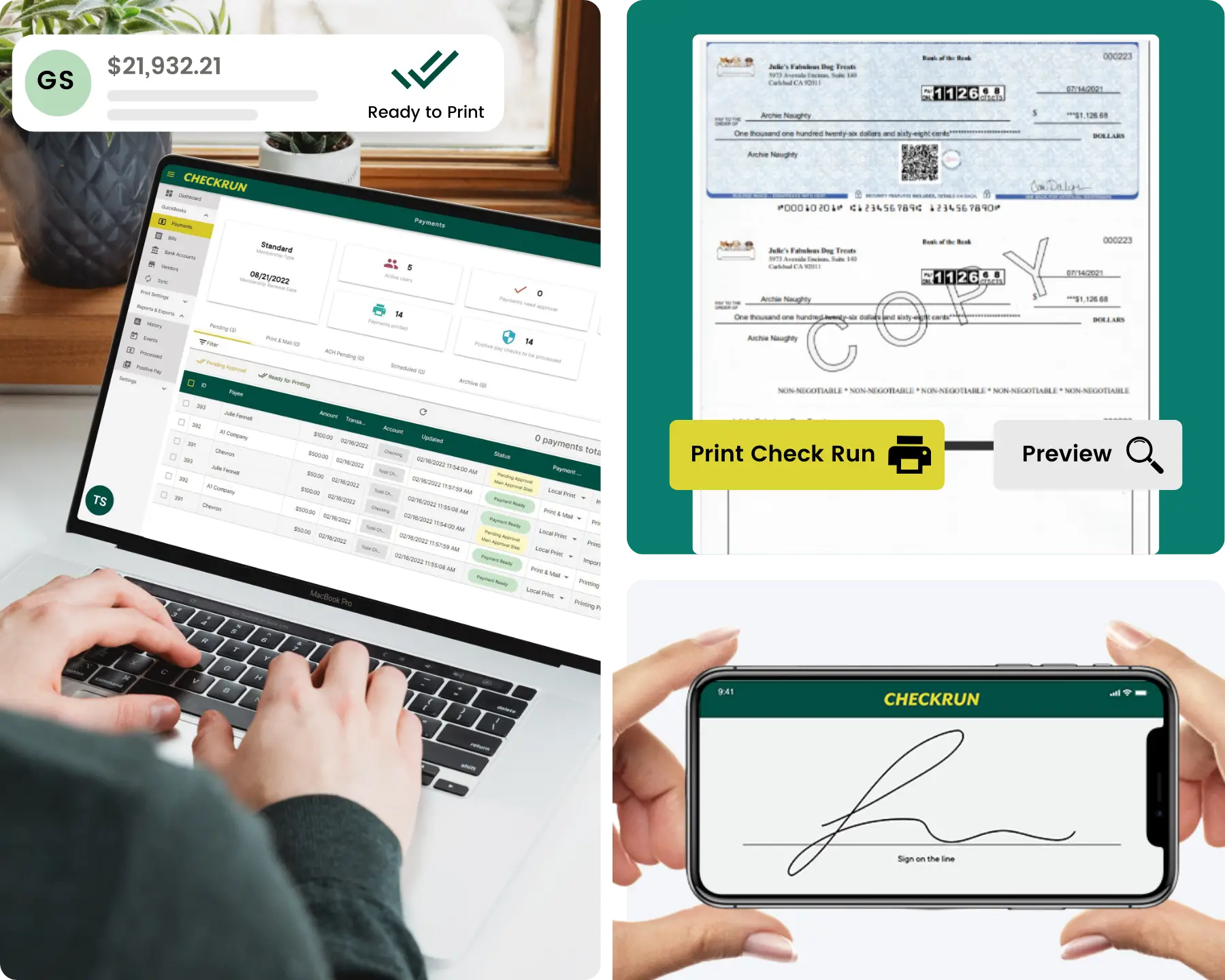

Set Up Vendors

Add account & routing information in Checkrun.

2

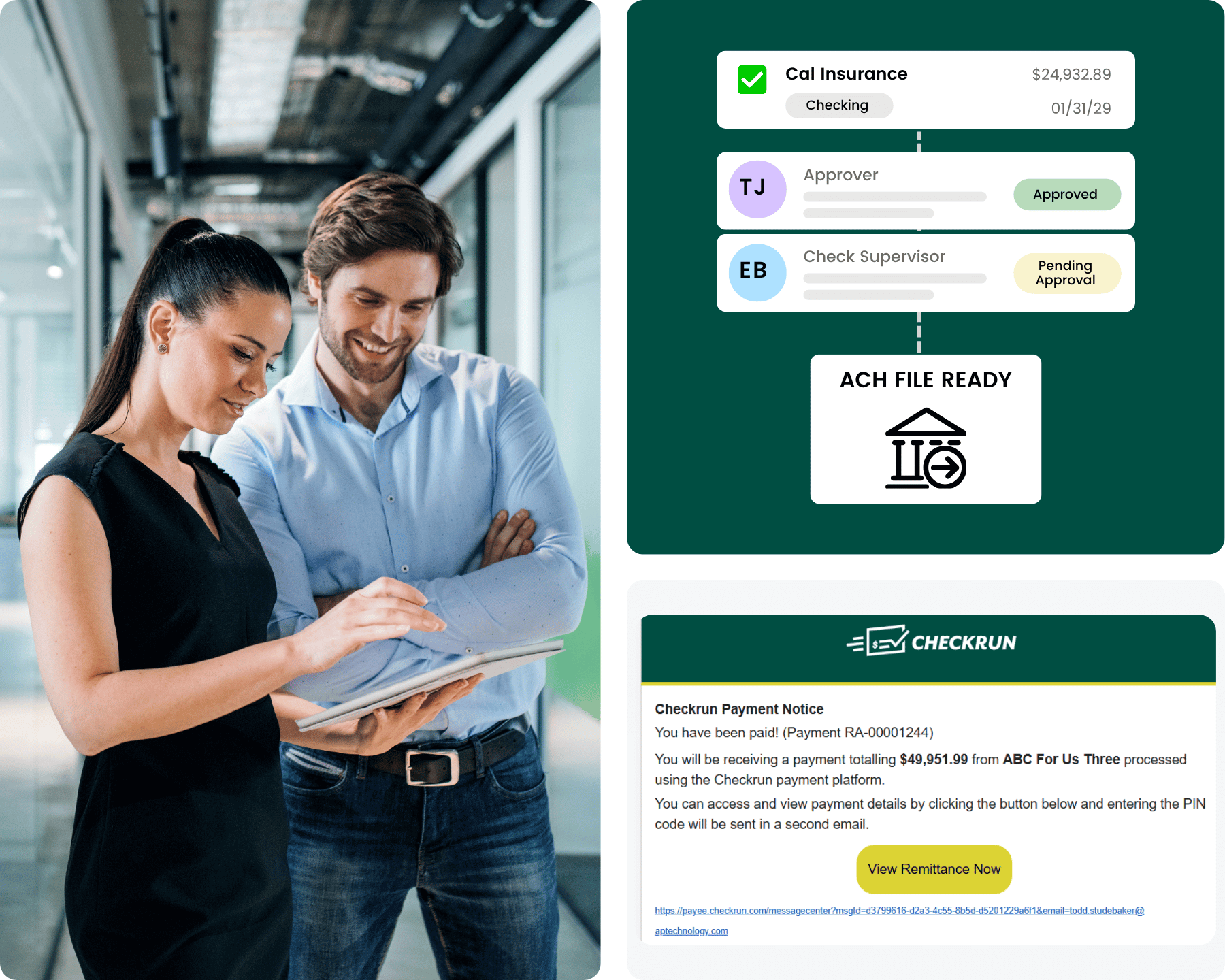

Approve Payments

Use Checkrun’s approval workflows for secure internal sign-offs.

3

Export ACH File

Click “Create ACH File” and save it to your desktop.

4

Upload to Bank Portal

Log into your bank and upload the ACH file. Done!

Why Use Checkrun for ACH File Export?

More control, less hassle—ACH payments made simple, secure, and tailored to your workflow. It’s a smarter, more flexible alternative to third-party platforms.

Use Your Own Bank

Maintain your trusted banking relationship while sending ACH payments.

No Prefunding Required

Pay directly from your bank—no need to front funds to a third-party provider.

Faster Payments

Pay vendors more quickly than with traditional third-party platforms like Bill.com.

Full Approval Workflows

Leverage Checkrun’s advanced, configurable multi-step approvals for added security.

Free ACH Validation Tool

Powerful tool to validate and read your ACH files exported from Checkrun. Great troubleshooting tool when adding a new bank.

Save Time During Reconciliation

Reconcile every individual ACH payment with built-in tracking—no batch-level confusion.

Lower ACH Costs

ACH with your own bank often means lower fees than those charged by processors.

Remittance Delivery

Automatically notify vendors with detailed remittance advice for every payment sent.

Quick Vendor Setup

Enter ACH info once—Checkrun stores and secures it for future payments.

QuickBooks Online Compatible

Easily sync bills from QuickBooks Online, then manage payments in Checkrun.

Built for Businesses That Want Control, Compliance, and Confidence

Checkrun gives you secure, flexible control over vendor payments—with all the ACH features you need, and none of the extra fees.

Secure ACH File Generator

Create NACHA-compliant ACH files tailored to your bank’s specifications.

Smart Workflow Approvals

Customize your internal payment process with secure, flexible approval tiers.

Bank-Agnostic ACH Export

Use your preferred bank—Checkrun doesn’t lock you into one provider.

Automated Remittance Delivery

Automatically notify vendors with payment info and receipts.

QuickBooks Online Compatible

Sync bills from QuickBooks Online, manage approvals in Checkrun.

Simple Vendor Setup

Securely manage all vendor bank information and multiple accounts in one place.

Checkrun Is Built for Modern Business Payments.

Payments should be flexible, secure, and easy to manage—without giving away control.

Checkrun helps finance teams streamline accounts payable processes by combining approval workflows, secure vendor setup, and flexible ACH file exports—without requiring prefunding, tying you to one bank, or charging extra transaction fees.

- QuickBooks Online Compatible

- NACHA Compliant ACH File Export Software

- ACH Payment Solution for All Businesses

- Trusted by Growing Teams

Frequently Asked Questions

Still need help? Feel free to reach out to us via email, chat, or phone. In the meantime, please view our help desk.

What is an ACH payment?

Automated Clearing House (ACH) is a payment clearing facility for electronic funds transfer. It is a commonly-used network that provides a secure payment transfer system for businesses. ACH payment processing often provides businesses with quicker access to funds and can be a less expensive payment method compared to paper cheques and credit cards.

Do I need technical skills to generate NACHA files?

Not at all. Checkrun walks you through vendor setup and file generation step-by-step. No coding required.

What banks does this ACH file export work with?

Any U.S. bank that accepts ACH files, including Wells Fargo, Bank of America, Chase, and credit unions.

Is my vendor and banking info secure?

Yes. Checkrun uses bank-level encryption and secure data storage to protect sensitive information.

Can I use this with QuickBooks Online?

Absolutely. Import your bills from QuickBooks Online and sync with Checkrun to manage ACH payments seamlessly.

How do I provide remittance advice to my vendors being paid by ACH?

Checkrun introduces a new Bill Remittance Portal (Payee Portal) for vendors/payees to gain access to the remittance advice for the ACH Payment. If you have included an email address in the vendor record, we will use that to send one email, with link, to the Payee Portal and a second email with a unique pin code.

Will my file be formatted properly, per my banks specifications?

Yes, once you provide your bank’s specifications, our software ensures the file you request is formatted properly. Checkrun software supports multiple common Standard Entry Class Codes (SECs), such as: CCD (Cash Concentration and Disbursement) and PPD (Prearranged Payment and Deposit).

These businesses work smarter with Checkrun.

“I love Checkrun because it provides a secure, efficient, and paperless experience, allowing us to sign checks electronically, approve transactions, and process ACH payments all through a secure online platform. Plus, their customer service is always prompt and reliable.”

Abduselam I.

Director of Operations, Nonprofit

“Checkrun fills a big need for us in the area of printing checks from multiple accounts on Quickbooks on blank paperstock, with secure layouts. Especially important is the authorization workflows allowing remote signature for printing in office.”

Lee P.

FM, Construction

“It is the only cost-effective program that can print checks in QuickBooks and keep accurate records. Checkrun customer support has been outstanding. The product has very little down time.”

Ronald T.

President, Marketing & Reseach Firm

Ready to Make ACH Payments Easy and Affordable?

Export NACHA files in minutes. Stay in control of your bank and your business – with no prefunding.