Review and approve bills

Approve and pay business bills to multiple vendors, on any device, and on your time.

Pay vendors faster

Checkrun automates and streamlines your AP workflows, connecting your payments accounts and moving money remotely.

Simplify your payment process

Always know the status of your payments, schedule bills, and receive real-time notifications that alert you when a bill needs your attention.

Pay Vendors Securely, On the Go

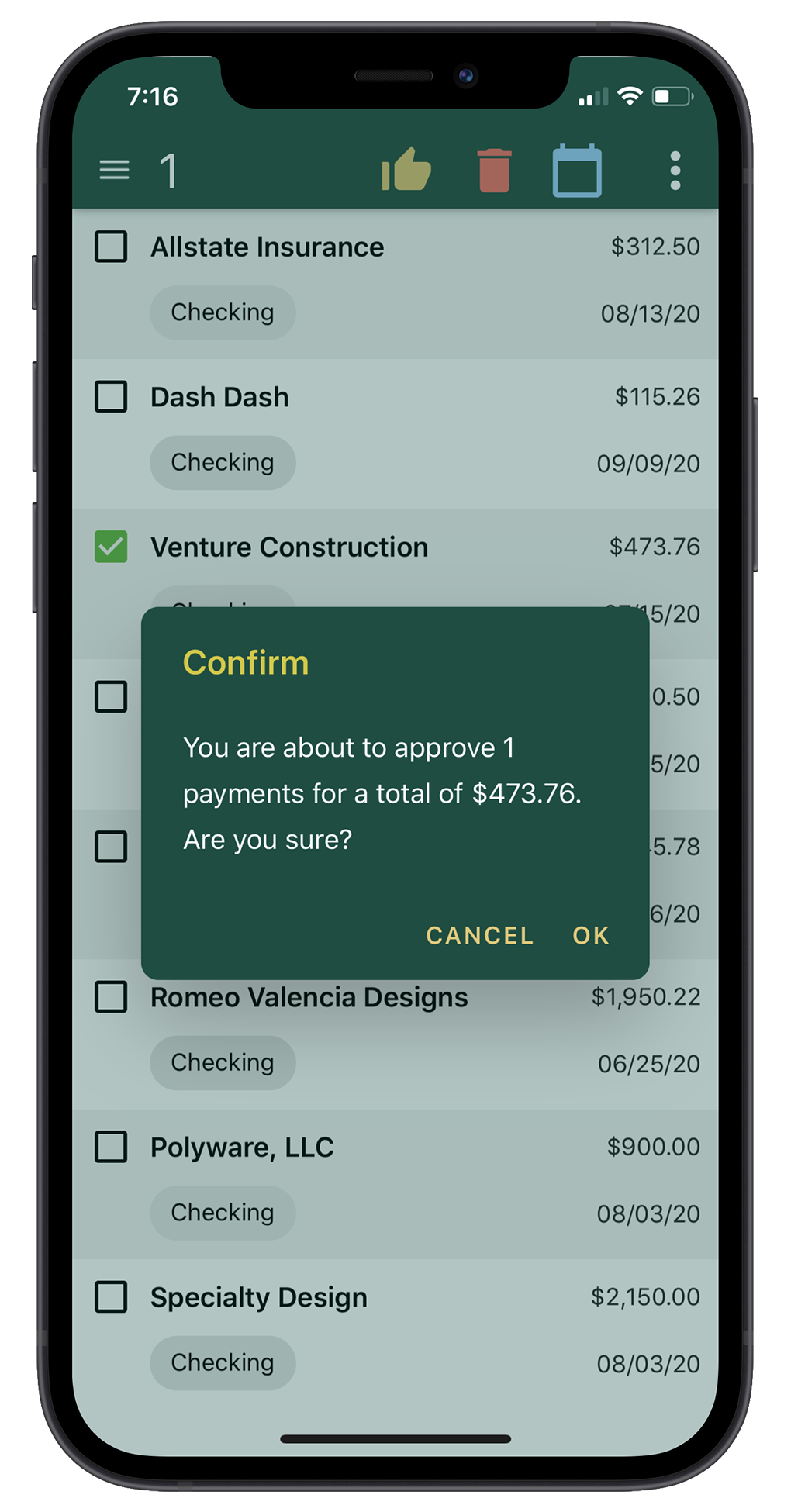

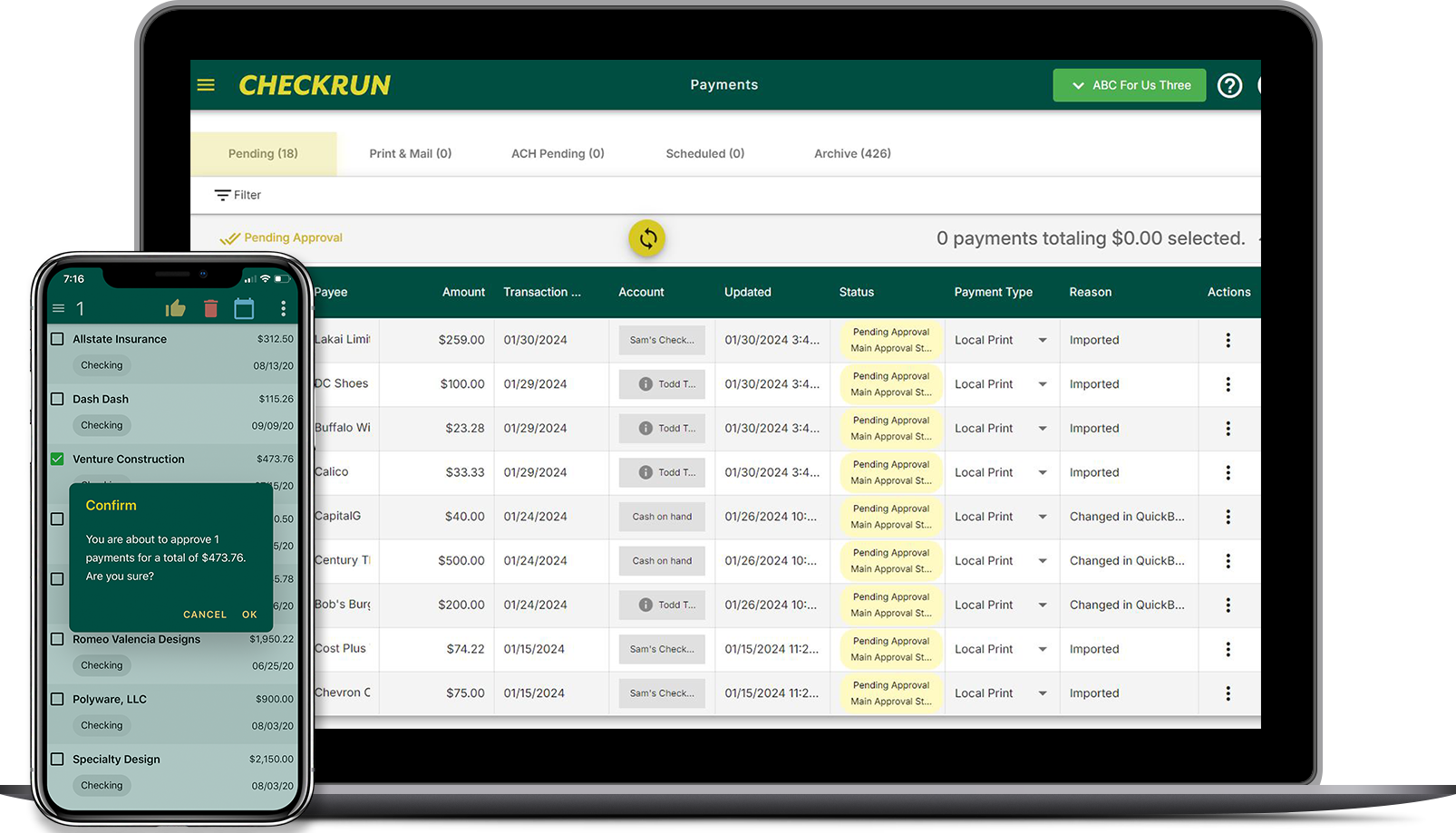

Accounts payable tasks like approving payments create delays and tedious work. With Checkrun’s Mobile Approval App, you can make payments -or approve bills- wherever you are, at anytime. This way you can approve, sign, and process payments 2x faster than before.

Business Payments at Your Fingertips

No tracking down approvers and no rushing back to the office to sign and cut checks. Checkrun’s mobile approval app makes it easy to sign checks when you are away from the office. Continue to meet deadlines and offer full-service professional bookkeeping services when working remote.

Secure digital signatures on payments

The Checkrun Mobile App makes it possible to approve and sign checks with a digital wet signature anytime, anywhere.

Stay on top of your workflow with auto-notifications

Checkrun email and push notifications let you know when your review, authorization or signature is needed.

Sync check images with QuickBooks Online

The Checkrun Mobile App offers check payment approvals and stores the image of the approved check in your QuickBooks Online account.

QUICKBOOKS ONLINE INTEGRATION

Sync your check payments with QuickBooks Online

A two-way sync between Checkrun and your QuickBooks Online account automatically adds all bills, invoices, supporting attachments, and payments into Checkrun – eliminating double data entry. Checkrun reconciles your bill payments back into your QuickBooks Online account.

The Checkrun App Makes It Easier To Pay Vendors

In order for remote teams to operate successfully, you need to have the right tools in place. Luckily, Checkrun makes it easy for finance teams.

Bill pay

Quickly and easily review, approve, and process your business bills and payments in one place while on the go. You can even print and mail checks from your phone.

Payment reminders

Easily meet payment deadlines with email and push notifications that let you know when a payment needs to be reviewed, authorized, or when a signature is needed.

Check Printing

Need to print your checks? Checkrun accommodates multiple print layouts, colors, and logos so you can customize your checks to suit your needs.

Approvals

Built for your unique processes. Set your internal controls, manage workflows, establish approval parameters, and gain full visibility into all of your payments.

Attachments

Access pending approvals, upcoming payments, and invoices/attachments. Your data is always available and synced directly to QuickBooks Online for peace of mind.

Advanced Settings

Need to set different permissions for different team members? Or, manage multiple accounts throughout the day? Checkrun can do that.

Audit trails

A built-in audit trail keeps track of every interaction a team member has with a bill or vendor – the best way to manage cash flow and keep payments secure.

Print and Mail Service

There’s no need to store pre-printed checks and supplies. With Checkrun’s same-day print and mail service, we take care of it all, for just $1.75/check!

Security and Protection

With features like Positive Pay, check fraud detection, and an audit trail on every bill, Checkrun is designed to keep you and your business safe.

Frequently Asked Questions

Is the Checkrun app a standalone app?

No, the Checkrun app works on top of the desktop platform. All data and actions are automatically synced between the mobile and desktop applications, so they’re always up to date.

Which devices can run the Checkrun mobile app?

Do I have to have a Checkrun account in order to use the app?

Yes. If you haven’t signed up yet, find out if Checkrun is right for your organization.

Where can I download the app?

You can find the app in the Google Play Store for Android or the Apple Store for iOS.