Check Payment Solutions for Accountants & Bookkeepers

Manage all of your clients’ business payments and streamline back-office accounts payable tasks from one easy-to-use platform. Setup custom approval workflows and print and mail professional check payments. Two-way Sync with QuickBooks Online to save time and avoid duplicate data entry.

Checkrun for Accountants & Bookkeepers

Comprehensive Payment Solutions for Accounting Firms

For accountants and bookkeepers, Checkrun’s check payment solution streamlines the accounts payable to reduce costs, simplify internal processes, and boost client satisfaction.

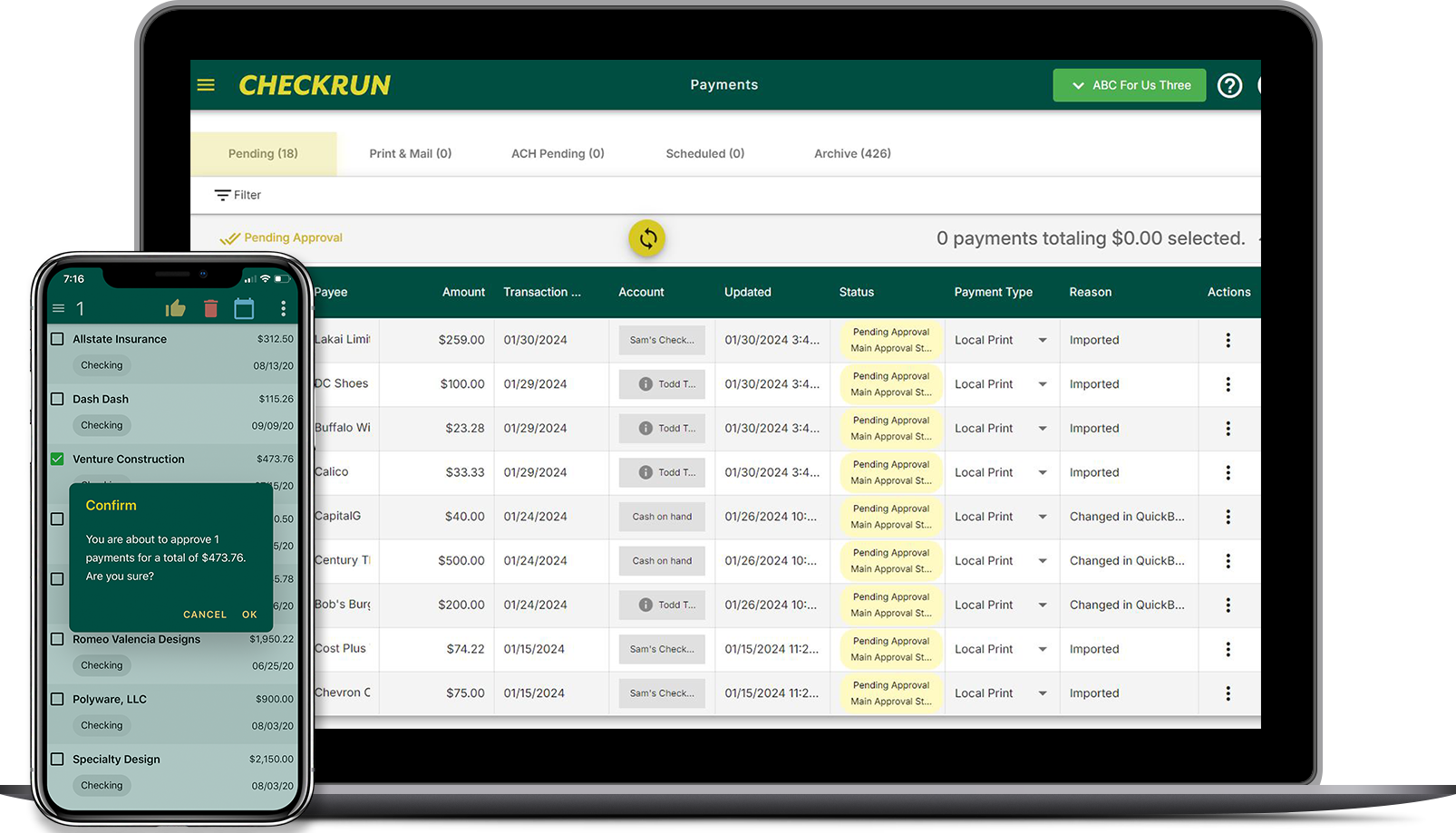

Streamline Approvals

Reduce the amount of manual work you need to do for your clients (like payment approvals and check signing), while eliminating errors and inefficiencies.

Save time, reduce errors

Still tracking down approvers to sign and cut checks? Easily set up approval workflows, so your clients can approve payments in real-time while staying in control.

Two-way Sync with QuickBooks Online

Connect your clients’ QuickBooks Online accounts to eliminate dual data entry and get automatic two-way sync for all bills and bill payments.

Improve visibility

Manage all client accounts in one place

The Checkrun dashboard gives you an overview of all of your clients and payment data. Easily switch between accounts and see a complete rundown into client’s payments – future, present and past – in one easy-to-use platform.

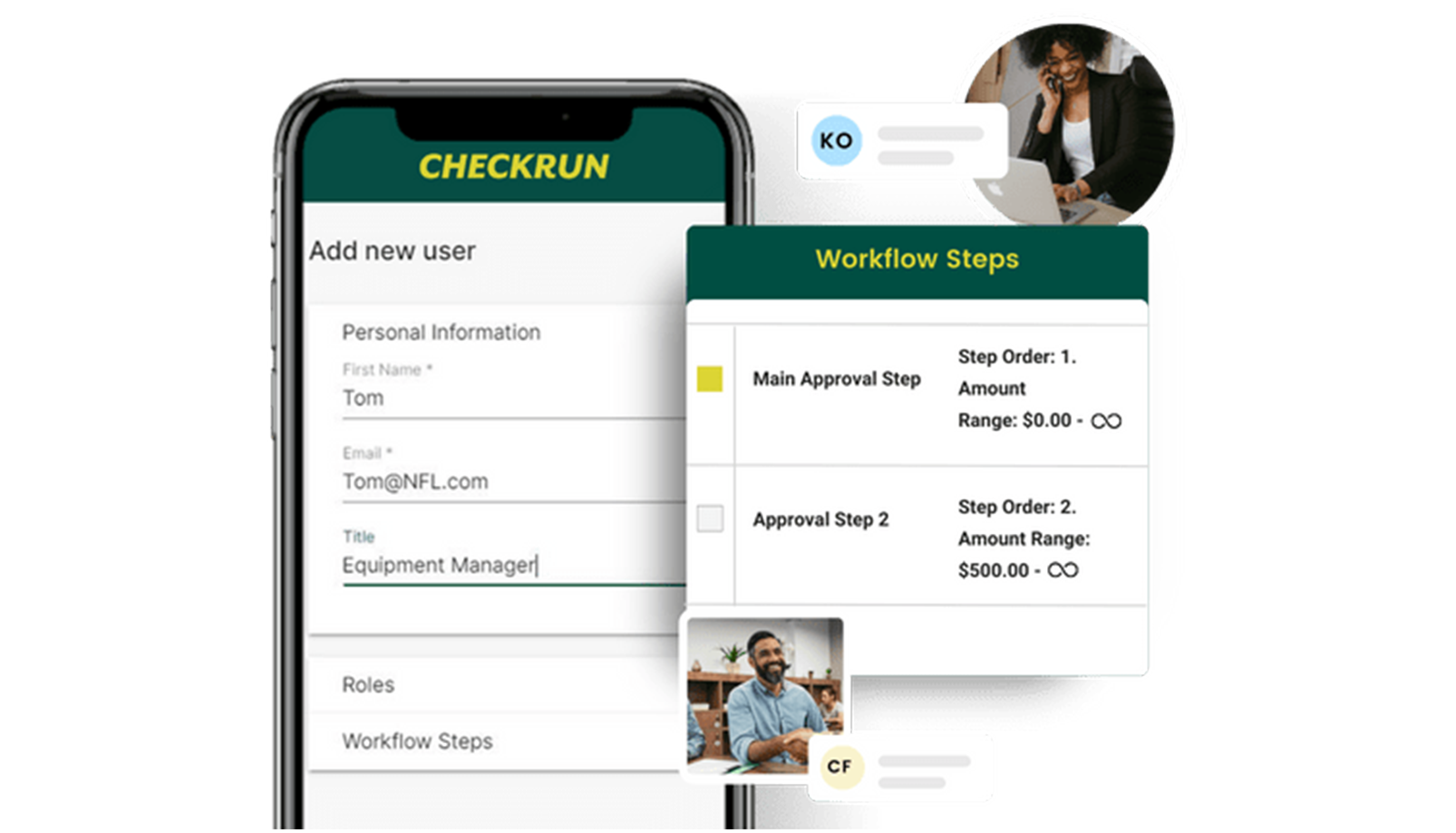

Seamless workflows

Custom workflows for every client and payment

Use custom user roles to automate every step of your AP workflow. Easily manage multiple accounts with a single login, payment approvals, and access archive check images directly in QuickBooks Online. Checkrun helps you establish continuous reliability and security for your client’s financial data.

Integrations

Two-way sync with QuickBooks Online

Eliminate manual work, double data entry and free up time for strategic planning with QuickBooks Online two-way sync. Create clear payment records, audit trails, and easy historical access to data for all your bills and payments.

Transforming business payments with secure and efficient solutions.

Fraud is scary – but it does happen. And, it happens more often than you think. With features like Positive Pay, check fraud detection, and an audit trail on every bill, Checkrun is designed to keep you and your business safe.

Positive Pay File Integration

We offer the largest positive pay library to protect your payments from fraud and security threats. Stay one step ahead of criminals and guard against fraud.

Advanced Security Features

We’ve added advanced security features to eliminate risk and liability. Biometric verification, Mobile Capture of live signature, built-in audit trails, secure QR codes, security fonts, microlines, and more.

TruPrint Blank Check Stock

Prevent check fraud, risk, and the liability of storing costly pre-printed check stock with our TruPrint high-security blank check stock. Keep overhead and expenses low – without forfeiting security or convenience.

Built for clients like yours.

Get a holistic view of your client’s finances, with more reliable data, less manual work and error-proof accounting.

For industries like:

Professional Services

Nonprofits

Construction

Financial Services

Retail & eCommerce

Transportation & Hospitality

Healthcare

For expenses like:

Contractors, permits, etc.

Inventory, storage and warehousing

Legal services

Office supplies

Technology and electronics

Events and convferences

Tools and equipment