Automate Approval Workflows & Manage User Roles

Approval bottlenecks, manual errors, and unclear roles can slow down your payment process and create compliance risks. With Checkrun’s powerful approval workflows and user role management, you can automate the entire process—ensuring speed, security, and control from anywhere.

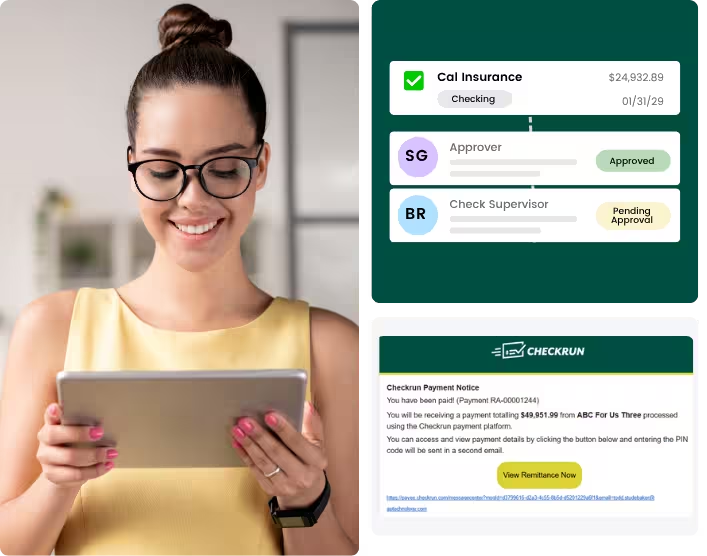

Customize and Automate the Way Your Team Approves Payments.

Checkrun makes it easy to build step-by-step approval workflows that fit your company’s structure—whether you have two approvers or ten. Automate multi-level approvals based on dollar amounts, departments, or specific payees.

With Checkrun Approval Workflows, You Can:

Route check payments to the right approvers in the right order

Assign roles like Approver, Signer, or Superuser.

Set conditions for approvals (e.g., check amount thresholds)

Control who can print, approve, sign, or send payments.

Automatically notify team members when their approval is needed

Limit permissions by account, amount, or user.

Eliminate delays and reduce back-and-forth email chains

Audit user activity with a complete trail of actions taken.

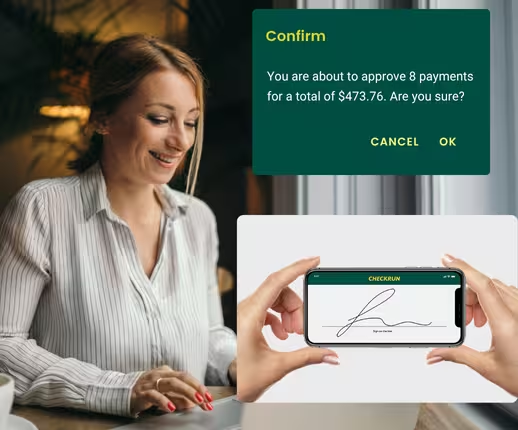

Stay in Control—Even When You’re on the Go

Checkrun’s iOS mobile app lets you approve checks anytime, from anywhere. Receive push notifications the moment your attention is needed and keep the payment process moving—no matter where you are.

- Real-time approval and signing capabilities

- Push notifications for pending actions

- Secure biometric login and check previews

- Syncs with QuickBooks Online for seamless updates

Audit Trails & Reporting That Keep You Covered

With Checkrun, every approval, rejection, and action is tracked automatically. Get clear visibility into your entire approval process for internal reviews or external audits.

- Detailed logs of every approval and action

- Reporting by user, amount, vendor, or time period

- Easy export for auditors and financial teams

- Reduces risk of fraud and increases accountability

Why Finance Teams Love Checkrun

Avoid confusion and unauthorized access by assigning specific roles to every user in your Checkrun account. Whether it’s an admin, approver, signer, or viewer, each user can only perform tasks relevant to their role.

Easy to set up and fully integrated with QuickBooks Online

Secure and compliant with robust internal controls

Mobile-first design for approvals on-the-go

Smart automation saves time and reduces errors

Scalable solution for growing businesses and enterprises

Frequently Asked Questions

Still need help? Feel free to reach out to us via email, chat, or phone. In the meantime, please view our help desk.

How many users can I add to Checkrun?

You can add up to 10 users, as your team needs, each with specific roles and permissions. If you need more, please contact us and we can work with you!

Can I set different approval workflows for different accounts or vendors?

Yes! Approval workflows can be customized based on accounts, vendors, or payment thresholds.

Does Checkrun sync approval statuses back to QuickBooks Online?

Absolutely. All check approvals and changes are synced with QuickBooks Online to ensure records are up to date.

What if an approver is out of office?

You can assign alternate approvers or re-route approval steps as needed to avoid delays. All approvers will receive notification via email and text message so if they are out of office, they can still approve payments via the Checkrun mobile approval app.

Is the mobile app secure?

Yes. The Checkrun mobile app includes security features like biometric login and encrypted data handling.

Ready to Automate Your Approval Process?

Take the first step toward smarter, faster check approvals with full control over your team’s roles and responsibilities.