As a small business owner, maintaining control of cash flow is essential to keeping business operations running. But maintaining positive business cash flow isn’t as easy as you would think; many entrepreneurs struggle with it. Developing the right strategies to control the revenue coming in and expenses paid out of your business gives you the power to meet your financial obligations and the flexibility to grow with new opportunities.

Checkrun is a secure, convenient and cost-effective accounts payable solution to help small businesses streamline the payment approval process; a powerful tool that can also help you maximize and improve your cash flow. Here’s how:

1. Pay bills from anywhere, at anytime

By making it easy and efficient to make payments, you will improve your cash flow management and reduce your payment financing needs. Checkrun solves the new challenge facing all businesses today – running your business remotely. The key, of course, is being able to securely make payments remotely while not giving up control or security.

With Checkrun, it’s your business on your terms. Checkrun’s approval workflows, on-the-go check signing and check printing can all be performed remotely. This enables you to know how much cash is going out at all times. Plus, you have the ability to manage and issue checks directly through the Checkrun cloud or Mobile Approval App. You can eliminate the inefficiencies from your current accounts payable processes, and provide real time benefits from remote approvals and check signing.

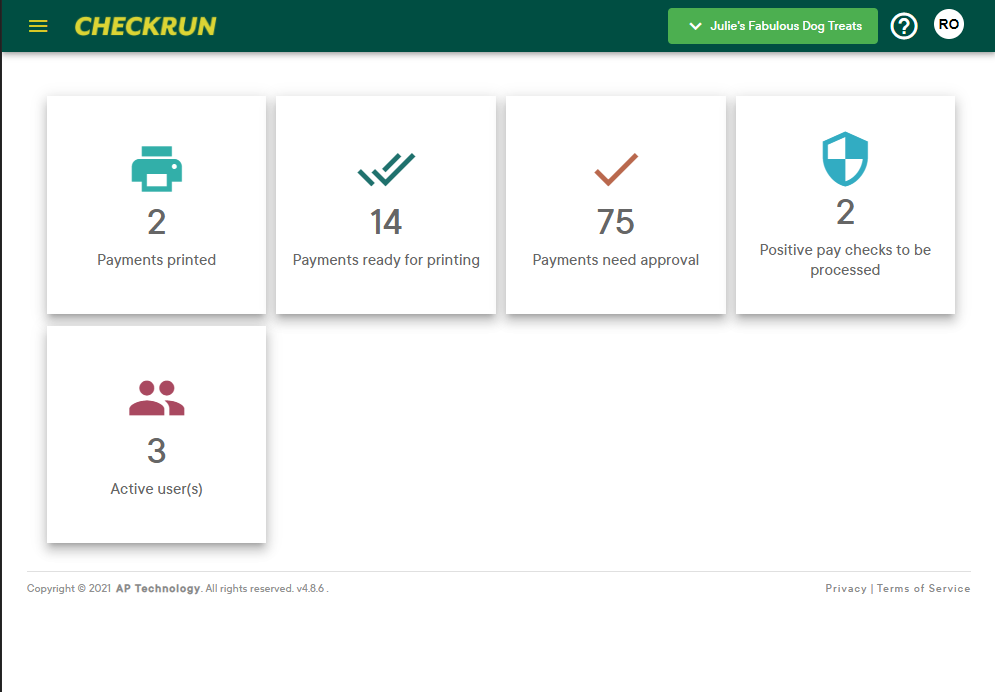

2. Centralize your payment management

Whether your team is working in the office, in the field, or remotely, Checkrun keeps all your business payments centralized online and your team connected. You can easily switch between accounts and see a complete rundown of your payments – future, present and past – in one easy-to-use platform.

Checkrun provides a simple and flexible way to manage every step of your company’s payment workflow, removing the time, space and security limitations that hinder maximizing your business cash flow. With Checkrun, you can increase control and visibility, easily route payments approvals to the right person, and review all invoices and documentation from one place.

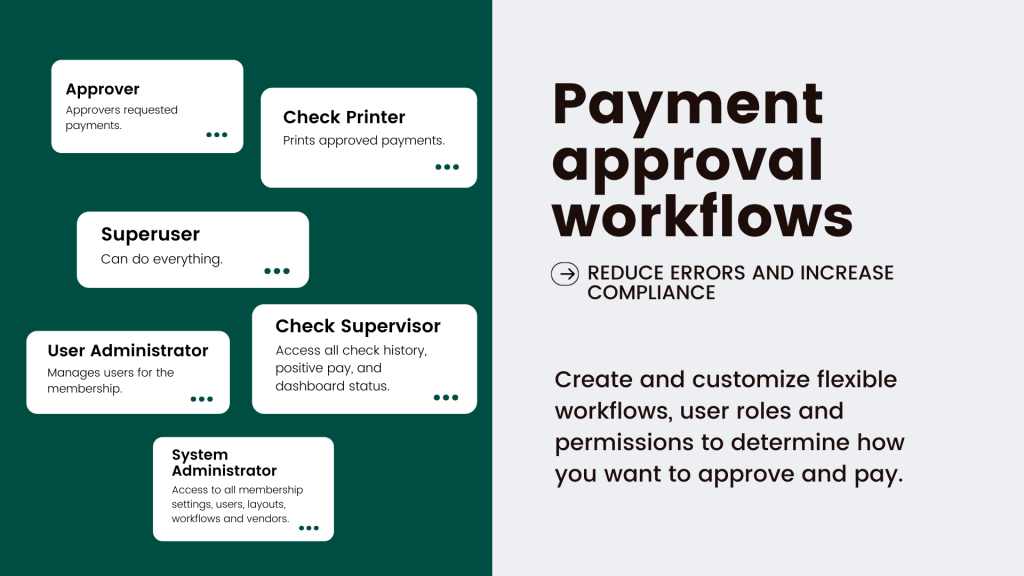

3. Implement payment approval workflows

Developing internal workflows for approving and reviewing payments before processing gives you better control and visibility of the payments going out. It also solves the challenges of transparency, human error and fraud risk that can negatively impact your cash flow.

Checkrun lets you define and assign user approval roles to workflows in order to automate and increase visibility into every step of the approval process. You can customize approvals by creating multi-step workflows with approvals based on amounts, approvers, and more. Checkrun can even send proactive push notifications, text messages and emails for every workflow step to ensure you never miss a payment.

This way, approvers are always aware when their review, authorization or signature is needed. As a small business owner, these management capabilities keep your payments secure and help to keep your team focused on their daily activities. Plus, they will help to better keep track of your cash flow and make your payment process much more efficient.

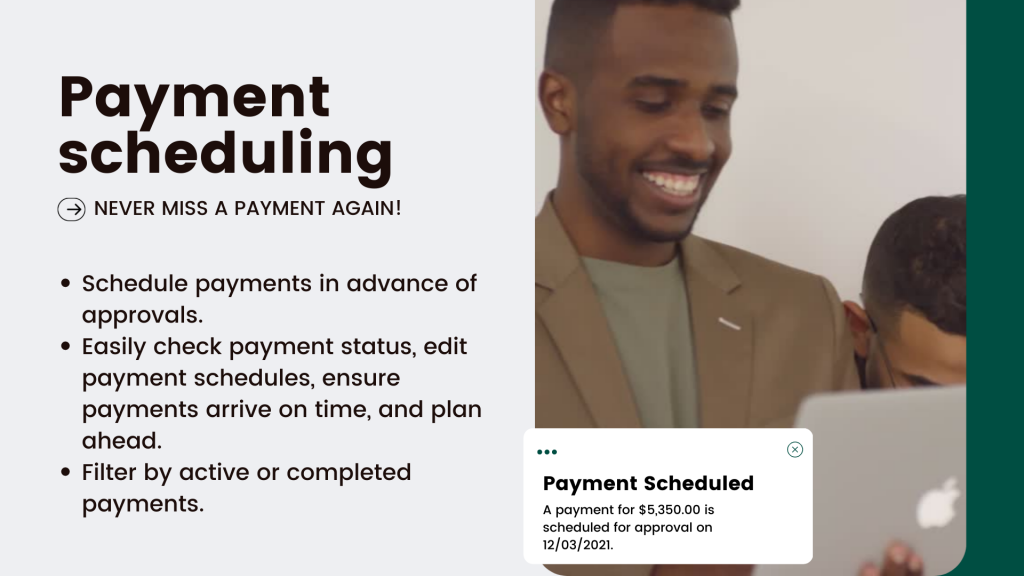

4. Schedule your payments – never miss a payment again!

Maximize cash flow control for your organization, by staying on top ahead of unpaid and overdue invoices by using Checkrun’s payment scheduling capability. Checkrun enables you to schedule payments in advance of approvals, allowing you to manage when the funds are paid to your vendor.

Checkrun provides a clear view of all your past and scheduled payments in one place. Allowing you to easily check payment status, edit payment schedules, ensure payments arrive on time, and plan ahead. You can even filter by active or completed payments enabling a clear view of the dynamics of your cash flow. With the Checkrun automation and remote capabilities, you will spend less time chasing after getting payment approvals and focus more of your time on serving your clients. It’s a guaranteed way to ensure payments are approved and signed on time – every time.

5. Track your payments

You can’t manage, improve or increase your cash flow unless you keep track of it. Checkrun helps you monitor your cash flow and track the status of your payments from the moment they’re scheduled. Checkrun keeps your payments secure by automatically keeping track of your approvals and payment details for historical accuracy and audit trails. Checkrun also displays each payment’s status to reduce the risk of missed payments or oversight. Bills and supporting documents can be accessed in Checkrun Cloud and mobile apps, so you can easily review the details of a bill before deciding to approve or pay the bill.

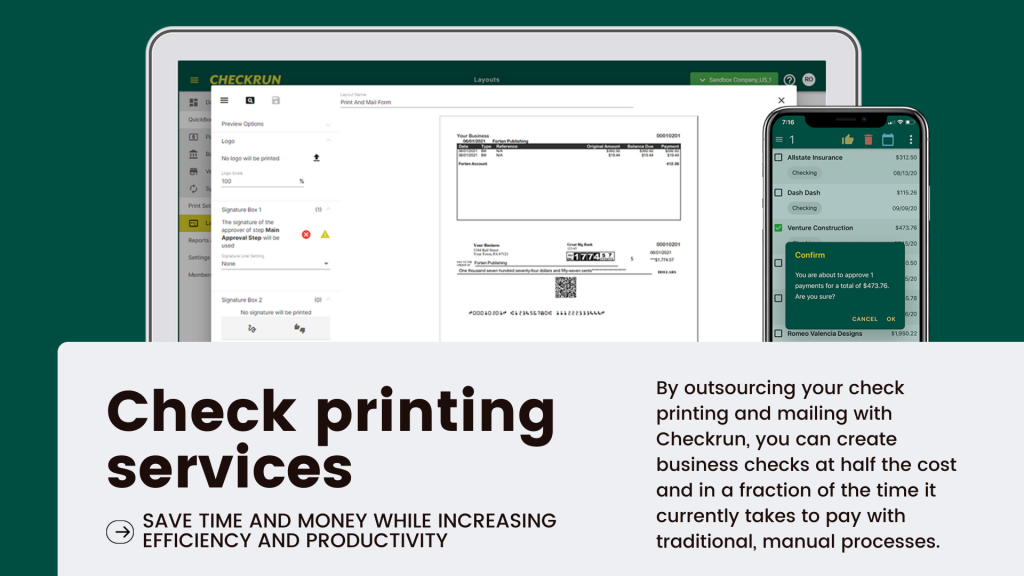

6. Make it easy to print and mail your business payments

Time, costs, and efficiency all affect your company’s profitability. A simple way to increase cash flow is to reduce spending where you can. With Checkrun your check printing and mailing can be handled completed for you. Free-up valuable time, increase productivity, and eliminate check processing bottlenecks and costs using our Print and Mail service.

By outsourcing your check printing and mailing with Checkrun, you can create business checks at half the cost and in a fraction of the time it currently takes to pay with traditional, manual processes. The same-day print and mail service eliminates the need to purchase and stock envelopes, check paper, and printer supplies – Checkrun handles it all for you. This way you can spend more on growing your business and cash reserves and reduce excess costs from time spent on manual work.

7. Streamline your payment process

When your payment data is scattered across different accounts and banks it can be difficult to run your business efficiently and smoothly. By securely managing your payments and multiple bank accounts on one platform, you have better insight into how your business runs. You can better identify potential errors before they happen, and you are able to create payment workflows that increase security and control. Streamlining your payment processes with a simple and easy solution is key to improving your cash flow.

Checkrun lets you easily manage business payments in one place, instantly approve and sign checks from your mobile device, and print and mail a more secure check with advanced security features. With Checkrun, you can improve and control your cash flow by improving the speed, efficiency, mobility and security of your company’s entire payment process.