Law firms are entering 2026 under increasing pressure to operate more efficiently—without compromising accuracy, compliance, or control. While client-facing legal technology has evolved rapidly, financial operations inside many law firms remain manual, fragmented, and time-consuming.

From vendor payments and settlement disbursements to operating expenses, how law firms pay vendors is becoming a critical focus area. Today’s legal tech trends show firms investing in tools that modernize repetitive back-office tasks—especially payments.

This is where law firm payment automation is shaping the future.

Legal Tech Trends Are Pushing Firms Toward Financial Automation

According to the Thomson Reuters Future Of Professionals report, law firms are prioritizing:

- Operational efficiency

- Reduced administrative overhead

- Better financial visibility and audit readiness

- Scalable workflows as firms grow

- AI as a driver of business strategy

While billing and payment management systems often get the spotlight, payment workflows are increasingly recognized as a major bottleneck—especially for firms still relying on manual check runs and disconnected approval processes.

In 2026, forward-thinking law firms are asking:

- How can we automate payments without losing float?

- How do we modernize checks while keeping them?

- How can we streamline workflows while staying compliant?

The Reality: Checks and ACH Still Dominate Law Firm Payments

Despite the rise of digital payments, checks are not going away in the legal industry. Many vendors, courts, medical providers, and settlement recipients still require paper checks. At the same time, ACH is increasingly used for predictable, repeat payments.

The challenge isn’t replacing checks—it’s modernizing how they’re managed.

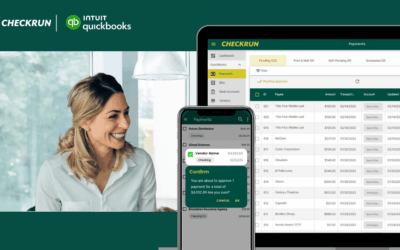

This is exactly where Checkrun fits into the future of law firm payments. Rather than forcing firms to abandon checks (which many vendors, courts, and settlement recipients still require), Checkrun modernizes the entire check process behind the scenes.

With Checkrun, law firms can:

- Issue checks and ACH files digitally instead of manually

- Route payments through automated approval workflows

- Automate check printing and mailing for vendors and settlements

- Export ACH files for bank processing without switching banks

- Maintain clear audit trails for every payment

- Reduce errors and administrative time spent on payment tasks

By removing manual steps while preserving the familiarity and acceptance of checks, Checkrun allows law firms to keep using checks—but in a way that is faster, more secure, and far more efficient.

Why Payment Automation Matters More Than Ever for Law Firms

As legal technology trends continue to emphasize efficiency and scalability, law firm payment automation is no longer optional—it’s a competitive advantage.

In 2026, law firms that modernize financial operations gain:

- Faster payment cycles

- Reduced overhead costs

- Fewer errors and reissued payments

- Stronger internal controls

- More time for high-value legal work

By modernizing payment processes with automation, law firms can reduce friction, improve compliance, and position themselves for sustainable growth in 2026 and beyond.

Ready to modernize your law firm’s payment process?

The future of law firm payments isn’t about eliminating checks or forcing new banking relationships. It’s about creating smarter, more efficient financial workflows that align with how firms actually operate.

Discover how Checkrun helps law firms automate check printing, streamline approvals, and manage ACH payments—without giving up control. Request a Checkrun demo today.