The Power of Electronic Remittance Advice: Why Vendors Prefer It

In business, how you pay someone is not only a reflection of how you work, it says a lot about how well you work. It’s not just about sending money—it’s about efficiency, consistency, and showing vendors they matter. That’s why more businesses are turning to electronic remittance advice to deliver payments, and peace of mind.

Building trust with vendors and clients is more critical than ever. Payment transparency isn’t just a nice-to-have—it’s a key part of fostering reliable, long-term business relationships and reputation. That’s where electronic remittance advice (ERA) comes in.

Vendors want to know when they’re getting paid, for what, and how. Clients want a simple, traceable way to show that payments are being made properly and on time. ERA bridges the gap between both—and Checkrun by AP Technology is a payment solution that makes it easier than ever.

What Is Electronic Remittance Advice?

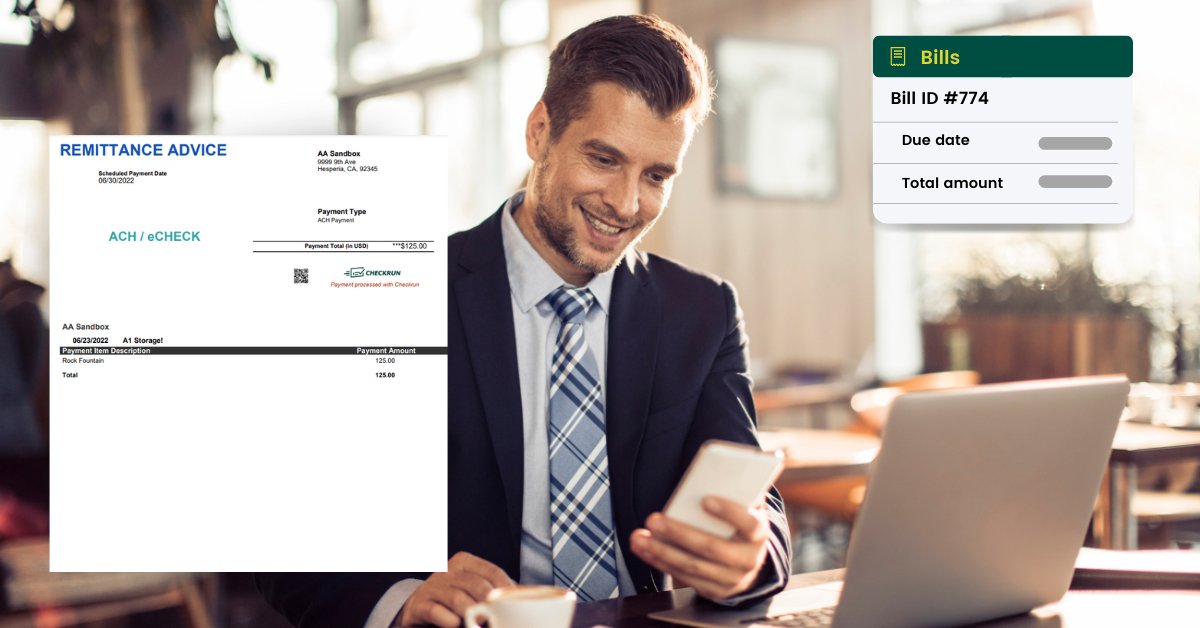

Electronic remittance advice is a digital version of a paper remittance statement. It details invoice numbers, payment amounts, dates, and other key information related to a transaction. Think of it as a receipt with context—a way to clearly communicate all details about a payment.

Instead of guessing which invoice a payment is tied to, or chasing down missing details, vendors receive an instant breakdown of each transaction. And because it’s digital, it’s faster, more secure, and easier to store or reference later.

Why Trust and Transparency Matter

Here’s the truth: delayed payments, unclear records, and missing communication hurt vendor relationships.

When vendors don’t know what they’re being paid for—or when—tensions rise. Miscommunications can stall deliveries, damage reputations, and slow down your entire operation. Electronic remittance advice brings clarity, accountability, and professionalism to your payments.

It shows vendors and clients alike that your business values clear communication, timely payments, and mutual trust.

How Checkrun Elevates Electronic Remittance Advice

Checkrun’s check payment automation platform includes built-in electronic remittance advice for every payment issued. Here’s how we do it differently:

- Automatic delivery: Vendors receive an electronic remittance statement as soon as payment is initiated. No need for separate emails or attachments.

- Custom messaging: Add personal notes or payment details so nothing gets lost in translation.

- Full visibility: Both internal teams and vendors can track payments from initiation to delivery.

- Cloud-based access: Everything is stored securely in the cloud for easy search, download, or audit.

Whether you’re managing one vendor or hundreds, Checkrun helps you create a smoother, more transparent payment process—building trust and reducing back-and-forth.

The Bottom Line: Vendors Prefer It

Electronic remittance advice isn’t just a digital convenience—it’s a smart business move. It improves vendor satisfaction, reduces disputes, and streamlines accounting workflows.

With Checkrun, you’re not just paying vendors—you’re keeping them informed, respected, and connected every step of the way.

Want to see how electronic remittance advice fits into your workflow? Book a free Checkrun demo and simplify vendor payments today.