Even in a world where digital payments, wire transfers, and ACH seem to dominate, many businesses still rely on paper check issuance. While technology continues to transform how we handle transactions, the benefits of business check payments remain a trusted and secure payment method for many industries.

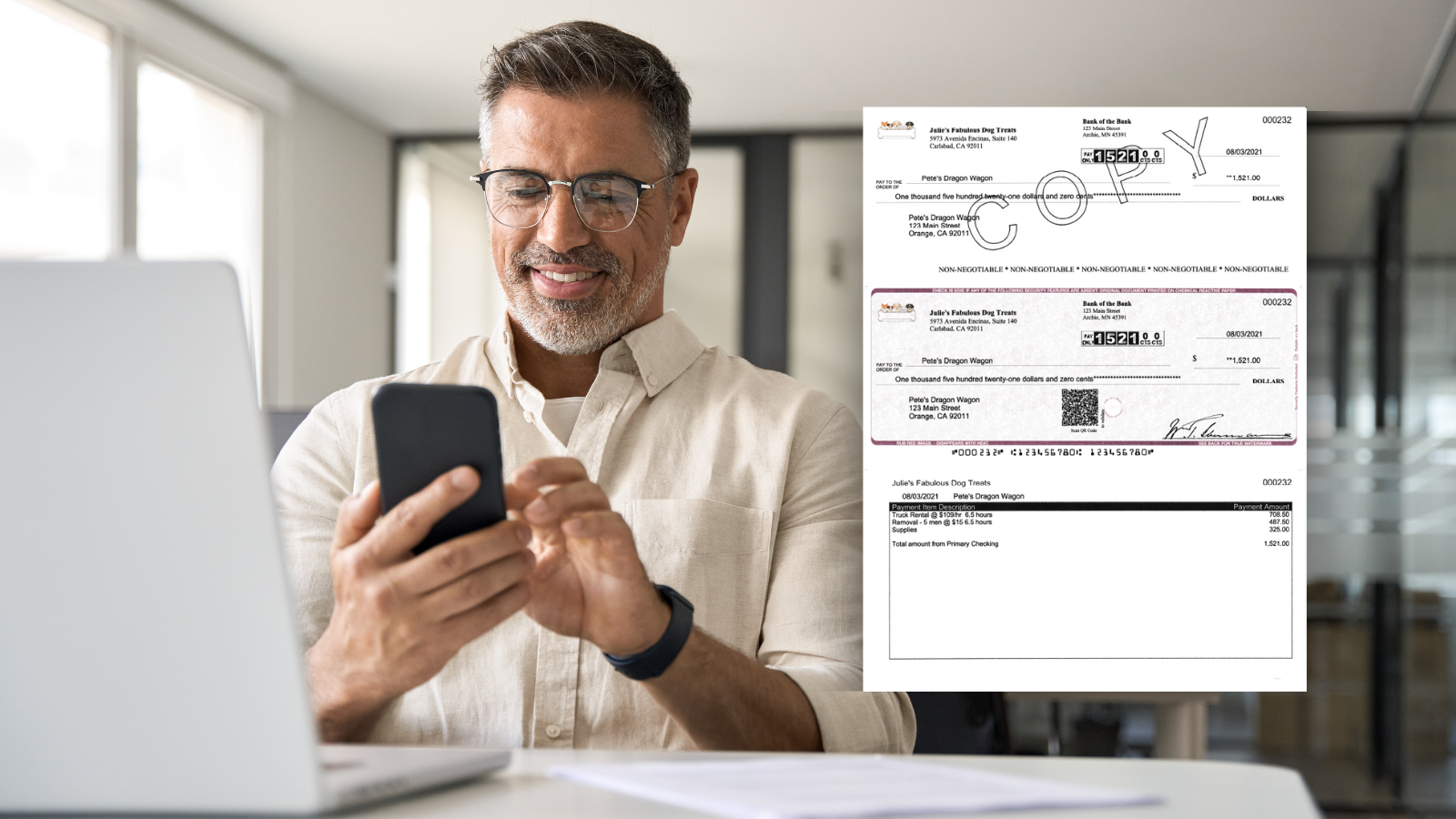

If your business needs a more efficient and secure way to manage and disburse check payments, an automated solution like Checkrun can make a big difference. It streamlines approval workflows, enhances security, and cuts down on manual work—helping you modernize check payments without losing the benefits they offer.

In this post, we’ll dive into why checks are still an important part of business payments and how Checkrun can help you simplify and improve your processes. Let’s get started!

The Benefits of Business Check Payments or Why Checks Still Matter

1. Enhanced Security & Fraud Protection

Checks offer a level of control and security that electronic payments lack. They provide a clear paper trail, making reconciliation easier. Unlike digital transactions that may be vulnerable to cyber threats, checks provide a traceable payment method that includes built-in security measures such QR codes, on-check security, and positive pay verification to combat fraud.

For some transactions, many businesses prefer the added security measures associated with checks, like dual authorization with signatures. While digital fraud is a constant concern, checks offer a sense of security, in conjunction with payment control and flexibility for certain transactions.

With Checkrun, businesses can further secure check payments by:

- Approving checks digitally and signing with an electronic signature prior to printing in order to prevent unauthorized transactions.

- Integrating Positive Pay to prevent fraud by ensuring banks only process approved checks.

- Using secure check stock for the Print and Mail option to minimize the risk of counterfeiting.

2. Greater Payment Control & Flexibility

Checks provide businesses with more control over payments, allowing for efficient payment timing and reducing the risk of missing deadlines. Unlike ACH or wire transfers, where funds are instantly deducted, checks give businesses time to manage cash flow more effectively. Additionally, Checkrun’s online check payment solution does not require prefunding. That means you are able to approve and process checks when you want! Payments are drawn directly from the bank, instead of relying on a third-party vendor to hold and then release payments.

Offering check payment options demonstrates flexibility and accommodates your client preferences, ultimately strengthening your business relationships.

Checks often are attached to detailed remittance advice, making it easier to track and reconcile payments. This is especially beneficial for complex transactions or when dealing with invoices with multiple line items. While digital payments can include memos, the structured format of check remittances is often preferred.

Checkrun helps businesses optimize this control by:

- Providing automated approval workflows to ensure checks are issued with proper authorization.

- Enabling remote check approvals, allowing business owners to review and approve payments from anywhere.

- Offering real-time tracking, so you always know the status of every check payment.

3. Universally Accepted Payment Method

While digital payments are growing, many vendors and clients still require check payments as part of their standard operations. Unlike credit cards or electronic transfers that may incur fees, checks offer a cost-effective alternative with no processing fees.

Checks can be used as a strategic solution to manage cash flow. They offer the flexibility to extend payment terms, allowing businesses to optimize their cash flow and maintain healthy financial operations.

With Checkrun’s seamless integration with QuickBooks Online, businesses can:

- Print and mail checks directly to vendors without going to the bank..

- Schedule check payments for bills to avoid missed deadlines.

- Ensure check payments are recorded in real-time, reducing reconciliation errors.

4. Professionalism & Business Credibility

For many businesses, sending a physical check conveys legitimacy and professionalism, especially in B2B transactions. Some vendors and clients prefer checks because they offer a paper trail that is easy to track and reconcile. Actual check images are made available to payees at time of transaction as proof of payment. This, along with the physical check, provides payment peace-of-mind while simplifying record-keeping and minimizing discrepancies.

With Checkrun’s cloud-based check printing and approval system, businesses can:

- Customize check layouts to include check preference, logos and branding for a polished look.

- Ensure all checks meet compliance standards, reducing risks of errors.

- Automate check signing with digital signatures to maintain efficiency.

How Checkrun Automates the Check Payment Process

While checks provide numerous advantages, manual check writing and approval can be time-consuming. Checkrun eliminates these inefficiencies with an end-to-end automated solution.

The benefits of business check payments are many, yet manually processing checks can be time-consuming and error-prone. This is where solutions like Checkrun come into play. Checkrun automates the entire check printing and payment process, from approving and signing checks to generating and printing checks.

- Increased Efficiency: Automating check printing and mailing significantly reduces the time and resources required for manual processing. This frees up valuable time to focus on other critical business tasks.

- Reduced Errors: Automation minimizes the risk of human error associated with manual check processing, ensuring accuracy and reducing costly mistakes.

- Enhanced Security: Checkrun offers robust security features to protect sensitive payment information, safeguarding against fraud and unauthorized access.

- Improved Organization: Checkrun provides a centralized platform for managing all check payments, simplifying record-keeping and reconciliation.

- Cost Savings: By streamlining the check payment process, Checkrun helps businesses reduce operational costs associated with manual processing, postage, and supplies.

Modernizing Check Payments with Checkrun

Despite the rise of digital payments, the benefits of business check payments make them an essential part of financial operations for many organizations. Checks offer security, control, flexibility, and professionalism—qualities that digital payments alone cannot always provide.

By leveraging Checkrun’s automated check payment system, businesses can enjoy all the advantages of check payments without the manual hassle. Whether you’re issuing payments to vendors, clients, or suppliers, Checkrun ensures your check payments are secure, efficient, and seamlessly integrated with your accounting system.Ready to streamline your check payments? Get started with Checkrun today!