Why Your Check Payment Tool Features Matter

The right features in your check payment tool can:

- Reduce manual data entry time by up to 90%

- Minimize payment errors

- Enhance security measures

- Improve vendor relationships

- Provide better financial visibility

Essential Features for Modern Check Payment Processing

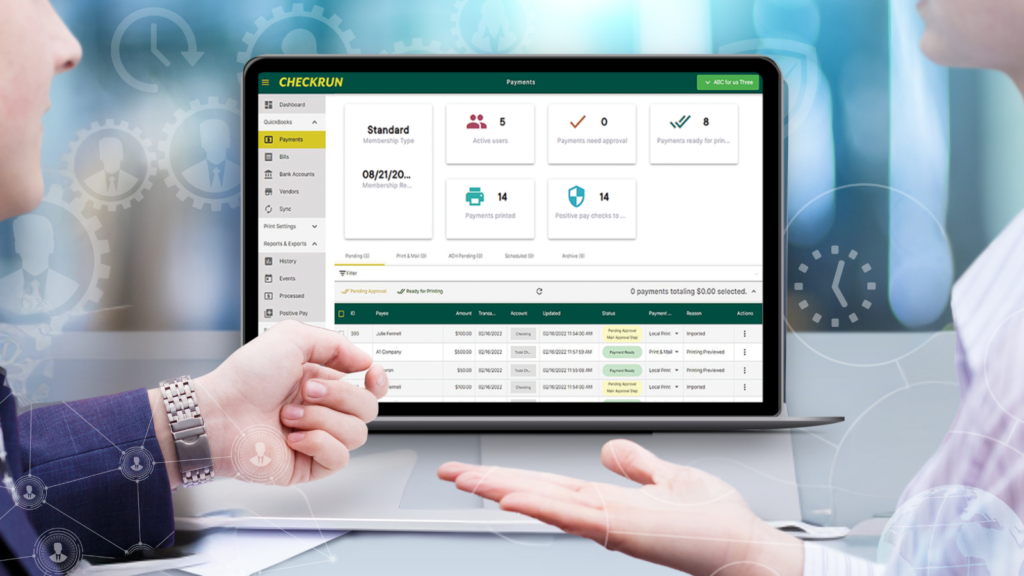

1. Seamless QuickBooks Integration

A robust check payment tool should offer:

- Real-time synchronization with QuickBooks

- Automatic payment data updates

- Error-free transaction recording

- Minimal manual intervention

2. Automated Payment Approval Workflows

Look for these capabilities:

- Customizable approval chains

- Mobile approval options

- Automatic notification systems

- Approval threshold settings

3. Batch Processing Capabilities

Essential batch processing features include:

- Multiple payment processing

- Bulk check printing

- Mass payment scheduling

- Batch payment reconciliation

4. Advanced Security Features

Priority security features should include:

- Positive pay file generation

- Check fraud prevention

- Encrypted data transmission

- Multi-factor authentication

- User permission controls

5. Digital Audit Trail

Ensure comprehensive tracking with:

- Payment history documentation

- User action logging

- Time and date stamps

- Change tracking

- Document attachment capabilities

6. Multiple Payment Methods Support

Look for tools that handle:

- Physical checks

- ACH payments

- Virtual credit cards

- International payments

- Wire transfers

7. Vendor Management Features

Essential vendor management includes:

- Vendor portal access

- Payment preference settings

- Automated remittance

- W-9 management

- Vendor information updates

8. Reporting and Analytics

Key reporting features should offer:

- Custom report generation

- Payment analytics

- Cash flow forecasting

- Spending trend analysis

- Export capabilities

9. Mobile Accessibility

Modern tools should provide:

- Mobile app access

- Remote payment approval

- On-the-go document capture

- Real-time notifications

- Cross-device synchronization

10. Customer Support and Training

Look for providers offering:

- 24/7 technical support

- Implementation assistance

- Training resources

- Regular updates

- Dedicated account management

Red Flags to Watch For

Be cautious of tools that:

- Require extensive manual data entry

- Lack regular security updates

- Have limited integration capabilities

- Offer poor customer support

- Use outdated technology

Future-Proofing Your Check Payment Process

Consider these emerging features:

- AI-powered payment optimization

- Blockchain security integration

- Real-time payment tracking

- Predictive analytics

- Enhanced automation capabilities

Conclusion: Transform Your Payment Process with Checkrun

After reviewing these essential features, it’s clear that Checkrun stands out as the premier check payment solution for QuickBooks Online users. Checkrun not only incorporates all the must-have features discussed above but exceeds expectations with its innovative approach to payment processing. Checkrun offers:

- The most seamless QuickBooks Online integration in the market

- Industry-leading security features with positive pay capabilities

- Automated approval workflows that save hours of manual work

- Remote, local, and same-day check printing capabilities

- Advanced vendor management with automated remittance

- 24/7 dedicated customer support from payment experts

Take Action Now

Don’t settle for outdated payment processes that cost your business time and money. Experience the future of check payment processing with Checkrun:

- Start Your Free Trial: Visit Checkrun.com to begin your 15-day free trial

- Schedule a Demo: See firsthand how Checkrun can transform your payment workflow

- Join the Revolution: Join thousands of satisfied QuickBooks users who have modernized their payment processes

Ready to upgrade your check payment process? Contact Checkrun today at [contact information] or visit our website to learn how we can help your business thrive.

Frequently Asked Questions

How long does it take to implement a new check payment tool?

Implementation time varies, but with Checkrun, most businesses are up and running within 30-minutes.

Can I maintain my existing payment workflows?

Yes, most tools allow for customizable workflows, with Checkrun offering the most flexible options for adaptation to your existing processes.

What kind of ROI can I expect?

Businesses typically see a 50-80% reduction in payment processing time and costs within the first month of implementing a modern check payment tool.