Essential Features of Legal Trust Accounting Software for Law Firms

Managing client trust accounts is a critical responsibility for law firms, especially those handling personal injury settlements, IOLTA accounts, and fiduciary funds. To ensure compliance with ABA (American Bar Association) regulations and state bar rules, law firms need the right legal trust accounting software to streamline transactions, track funds, and prevent financial mismanagement.

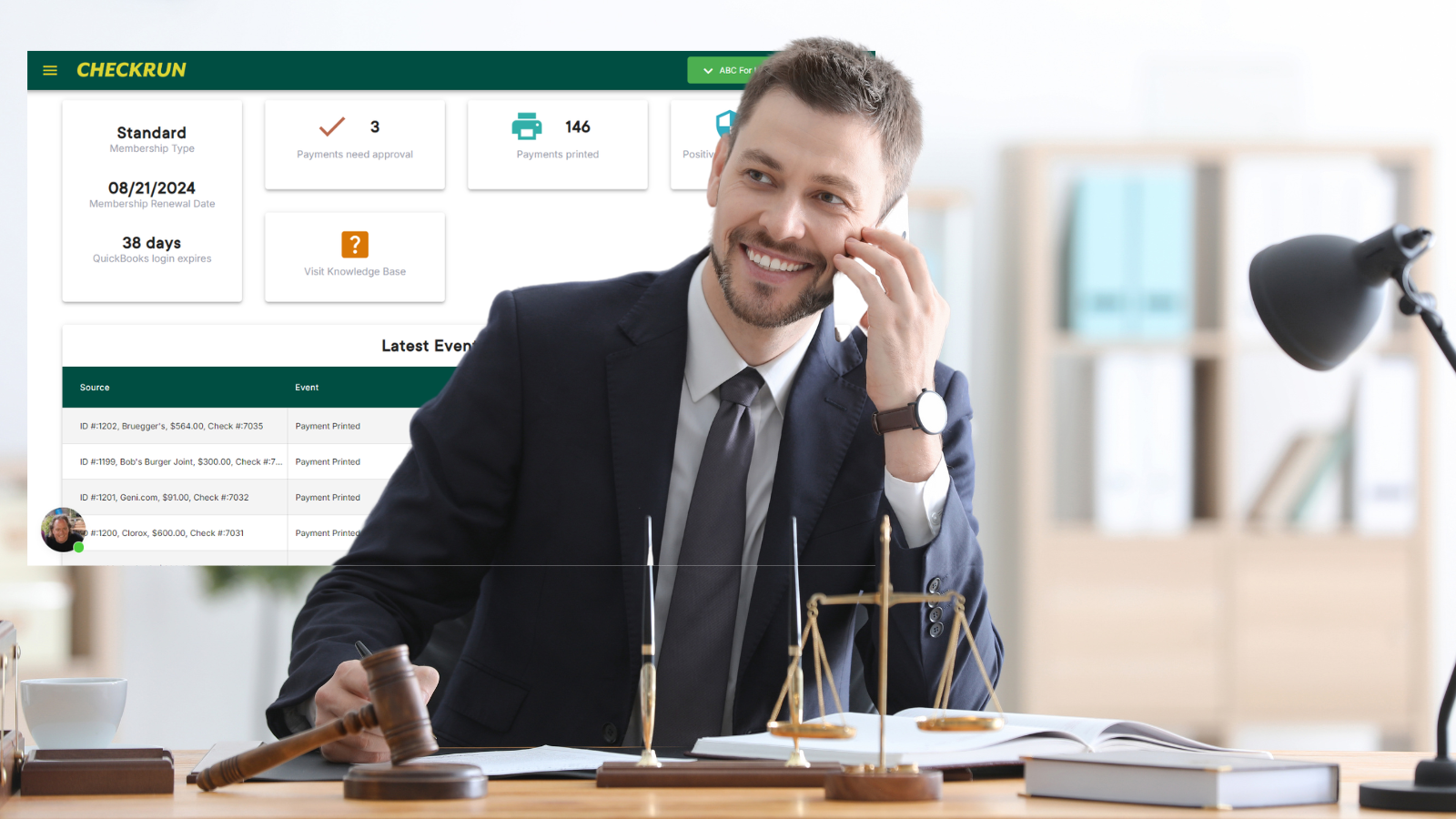

In this article, we’ll explore the essential features every law firm trust accounting solution should have and why Checkrun is the best online check payment solution for attorneys.

Why Law Firms Need Legal Trust Accounting Software

Handling trust accounts manually or relying on basic accounting tools like QuickBooks alone can increase the risk of errors, non-compliance, and ethical violations. A trust accounting solution for lawyers ensures:

✅ Accurate fund tracking – Keep client funds separate from operating accounts.

✅ IOLTA compliance – Prevent commingling of funds and automate reporting.

✅ Fraud prevention – Secure transactions with built-in approval workflows.

✅ Streamlined payments – Automate online check payments and approvals.

Now, let’s look at the must-have features of trust accounting software for lawyers.

Top Features to Look for in Legal Trust Accounting Software

1. Automated Trust Reconciliation & Reporting

Trust accounting requires meticulous record-keeping. Look for software that:

- Generates automated reconciliation reports to ensure compliance.

- Tracks settlement disbursements for personal injury cases.

- Provides audit-ready financial reports to meet legal industry standards.

2. Seamless QuickBooks Online Integration

A great legal trust accounting solution should integrate with QuickBooks Online for:

- Real-time transaction syncing to prevent double data entry.

- Accurate fund categorization for client retainers and settlements.

- Easy tax reporting to streamline year-end financials.

3. Secure Online Check Payments & Approvals

Traditional check writing is time-consuming and prone to fraud. A modern online check payment solution should:

- Allow digital check creation and approval workflows.

- Provide multi-user access controls to prevent unauthorized transactions.

- Offer remote check printing for convenience.

4. Compliance-Driven Fund Management

To prevent mismanagement of client funds, your software should:

- Track multiple client trust accounts with ease.

- Generate three-way reconciliation reports for compliance.

- Set up alerts for low balances to avoid overdrafts.

Checkrun Is the Best Trust Accounting Software for Law Firms

If your law firm is looking for a secure, cloud-based trust check issuance payment solution, Checkrun offers everything you need:

✔️ Seamless integration with QuickBooks Online

✔️ Automated online check payments with approvals

✔️ Audit-ready reporting for compliance

✔️ IOLTA-compliant fund tracking

✔️ Secure check printing from anywhere

🚀 Get Started with Checkrun Today!

Don’t risk trust accounting errors—simplify fund management with Checkrun. Sign up today and experience the most efficient online check payment solution for law firms!