Why Law Firms Are Automating Settlement Check Payments

In the legal world, timing and accuracy aren’t just important—they’re critical. When it comes to issuing settlement checks or managing trust accounting, delays and errors can harm client relationships and create compliance risks. Yet, many firms are still tied to manual check writing and outdated processes.

The Risks of Manual Check Writing in Law Firms

- Delays in settlement payouts can frustrate clients who are waiting for compensation.

- Compliance risks arise when trust accounting isn’t handled precisely.

- Fraud exposure increases when sensitive client funds move through outdated systems.

How Settlement Check Automation Improves Law Firms

- Speed: Payments can be approved and sent quickly, ensuring clients receive their funds without unnecessary waiting.

- Accuracy: Automation reduces human error, especially when handling multiple trust accounts.

- Transparency: Digital workflows provide clear records for audits and compliance.

- Efficiency: My eliminating tedious manual payment processes, law firm personnel are free to pursue activities that generate revenue and growth.

Why Clients Notice the Difference

When clients receive their settlement checks promptly, trust in and satisfaction with your firm grows. A faster, more reliable payment process reflects professionalism and strengthens client relationships.

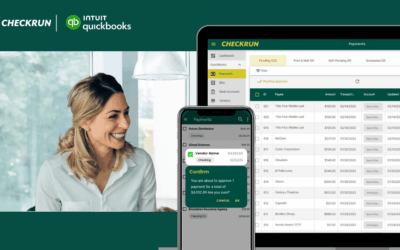

Where Checkrun Fits In

Checkrun makes it simple for law firms to automate check printing and approvals while maintaining full control and compliance. Whether managing multiple trust accounts or issuing high-volume settlement checks, Checkrun ensures payments are accurate, secure, and on time.

Law firms that modernize their payment processes not only reduce compliance risks but also deliver better client service. With settlement check automation, your firm can stay ahead—protecting clients, ensuring compliance, and strengthening trust. Discover how your law firm can improve trust accounting and client satisfaction by automating settlement checks with Checkrun.