Check fraud happens more often than we think and shows no sign of slowing down. It’s one of the easiest ways fraudsters can steal from your business when proper security features aren’t used on your checks.

But, using the best business check paper can help prevent this devastation from happening to you.

We’ve put together this quick guide to help you choose the best business check paper, so you can protect your company against fraud and safeguard your finances.

What is business check paper?

Simply put, check paper is the paper used for printing business and payroll checks. Check stock paper can be used with most check printing software and printers. It is specifically designed to prevent check fraud and forgery, with built-in security features such as microprinting, security warnings, and watermarks.

Blank check paper comes in a variety of different styles and even more ways to categorize them. The paper you need will depend on these factors:

- The software system you use to issue checks;

- The amount of security you want to have in place;

- Pre-printed vs blank check stock.

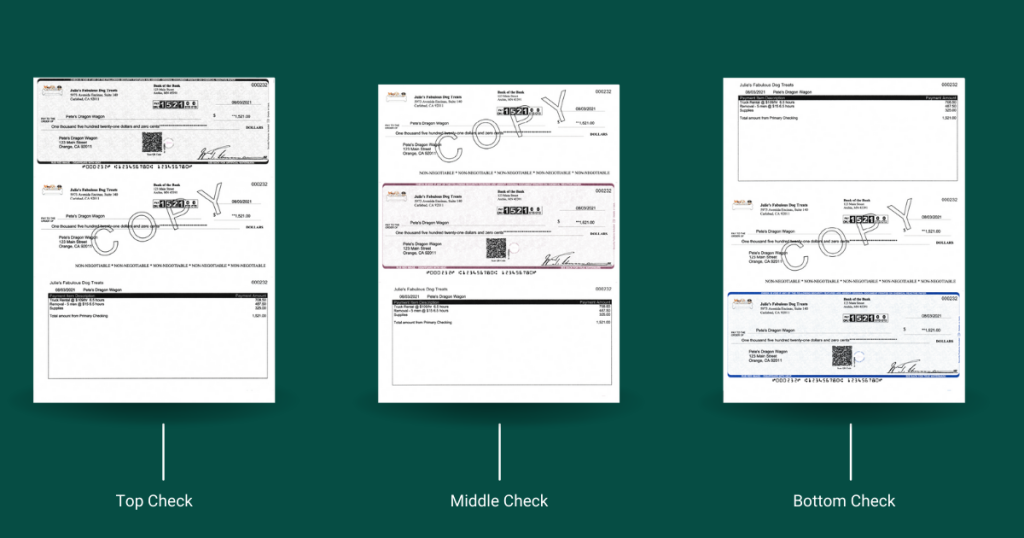

The simplest way to determine which check paper works with your software is to consider the position of the actual check on the paper—is it at the top, middle, or bottom of the page?

Types of check paper. TruPrint Blank Check Stock.

How to choose the best business check stock

Your accounting or bookkeeping software will determine which style of check paper you will need, but you still need to decide—pre-printed or blank check stock? And how much security?

When it comes to purchasing your business checks, you don’t have to go through your bank anymore. More individuals and businesses are choosing to order their checks from trusted online sources that offer all kinds of options and price points. Online business check options include a number of security features that provide you the same level of security you’d expect from your bank checks.

That said, not all business checks are created equal. Before you start shopping around, take some time to learn about the security features you will need, and what the difference between pre-printed and blank check stock can mean for your business needs.

Check stock: what’s out there?

Pre-printed check stock

Pre-printed check stock may seem like the easiest way of issuing check payments. But this isn’t necessarily the case, nor is pre-printed paper more secure. Pre-prints are actually a more risky, expensive, and inefficient method for printing business payments.

With check fraud on the rise and showing no signs of stopping, using pre-printed check stock exposes businesses to higher security risks. Because a pre-printed check already has certain banking data items already printed on the checks, such as the bank routing and account numbers, this stock is a valued target for thieves and fraudsters. Using this stock exposes businesses to theft, forgery, counterfeiting, and alteration. And stolen pre-printed checks can go undetected for long periods of time.

Combine that with the added time of logging and maintaining check inventory, along with inefficiencies that can cause errors in your check processing procedures, and it becomes clear that using pre-printed check stock can come at a price.

You could find yourself running through pre-printed stock, as printer jams or poor print jobs result in voided checks that ultimately result in higher costs, accounts payable nightmares, and more custom orders.

For every $100 a company spends to purchase a case of pre-printed checks, an additional $15 is typically spent on paper waste, and pre-printed checks are often thrown-out when static data edits are made.

Blank check paper

Using blank check paper with security features is a more efficient, streamlined, and secure way to go. Making a switch from pre-printed checks to blank checks can save your business up to 82% on internal processes and paper costs.

Since the check stock is blank, client-specific data does not appear on the check until it is printed. It doesn’t become a “live” check until it’s imprinted with bank-ready details and MICR toner, so there’s no need to worry about keeping it under lock and key.

No more wasted time logging inventory, keeping checks under lock and key, or changing the stock in the printer. Now you can quickly and easily print all of your checks, from multiple accounts, on the same paper. Blank check stock helps businesses avoid the risk of fraudulent checks. It keeps expenses low, without forfeiting services, appearance, or security features.

We highly recommend the use of blank check stock for all businesses. That’s why we’ve developed our TruPrint High-Security Check Stock with powerful features that block tampering and counterfeiting, while ensuring highest data security, confidentiality and secure processing.

Check fraud uncovered

As the leading method of B2B payment fraud, impacting 74% of companies, check fraud is of key concern for organizations everywhere. Through the use of computer technology and basic resourcefulness, criminals are finding it increasingly easy to reproduce and manipulate checks to defraud consumers and businesses.

Check fraud also costs companies and individuals billions each year, and part of what makes it so common is that it’s easy. Every check you print out is full of information – your name, address, bank name and account number, routing number, signature – these can all be used to commit check fraud. Reports of check fraud have risen 65 percent since 2015, and the typical loss is about $2,000 — much higher than losses for other types of fraud, the Federal Trade Commission reported this year.

As check payments comprise almost half of all business to business payments, robust fraud protection measures are a necessity in order to safeguard your organization’s accounts. Yet, despite the high incidence of fraud and the high cost involved, checks remain the most popular form of payments between businesses, according to a survey of treasury and finance professionals by the Association for Finance Professionals.

Now more than ever, fraud prevention and protection practices are crucial to protecting your business from payments fraud.

How to prevent fraud

Now, the good news. There is a long list of safety features embedded within quality check paper that work to deter fraudsters and to minimize the chance of a fraudulent transaction. Here are a few examples:

- Chemically sensitive paper: This prevents your check from being washed by scammers using chemicals. Typically, checks with this feature will change color when treated with chemicals, making it easier for the bank to identify they’ve been altered before they can be cashed.

- Microprinting: To the naked eye, these appear to be simple lines, but in fact they contain very small writing which is very difficult for forgers to duplicate with a printer or copier. Your bank can look at the microprint to determine if the check is real or a duplicate.

- Holograms and ultraviolet paper: These are difficult features for a forger to duplicate and ultraviolet paper and watermarks can easily be checked by bank personnel using a black light or by holding the check up to a light.

Quality business checks should be your first line of defense against fraud, but choosing the best check paper is only the beginning when it comes to a total, secure check printing solution. The real magic happens when you combine high-security, laser check printing software that includes MICR Printers, MICR toner, digital signatures, with industry-leading, secure blank check stock. By implementing check printing software in your workflow, you will greatly reduce the risk of fraud. You’ll improve bank processes and save your business money – whether you are using preprinted or blank check stock.

At Checkrun and AP Technology, we’re always available to share the knowledge acquired through our many years of experience with our clients. We know the importance of reducing costs associated with issuing checks, and are committed to working with you to make your business more efficient and secure.

Have questions or need more information about choosing the best check paper for your business? Want to learn how you can prevent check fraud? Contact us to set up a consultation.