Writing a check may seem like an old-fashioned practice in today’s digital world, but it remains a crucial method of payment for many businesses. Whether you’re paying a vendor, employee, or utility company, understanding how to write a check correctly is essential for maintaining smooth financial operations.

In this article, we’ll guide you through the steps of writing a check, and show you how Checkrun—a leading online check writing software—can make the process even easier, especially when integrated with QuickBooks Online.

How to Write a Check: A Step-by-Step Guide

Writing a check involves filling out specific fields on a physical check to authorize a payment. Here’s how you can do it properly:

- Date the Check: In the top-right corner of the check, write today’s date. This lets the recipient know when the payment was made and helps with record-keeping.

- Payee Name: On the “Pay to the Order of” line, write the name of the individual or business you are paying. This tells the bank and the recipient who is authorized to cash or deposit the check.

- Payment Amount in Numbers: Write the exact payment amount in numerical form in the small box next to the payee’s name. For example, if you’re paying $150.75, you’ll write “150.75” in this box.

- Payment Amount in Words: On the line below the payee’s name, write the payment amount in words. This step helps avoid confusion and fraud. For example, “One hundred fifty and 75/100 dollars.”

- Memo Line: The memo line at the bottom left of the check is optional but helpful. Here, you can add a note to indicate the purpose of the payment, such as “Invoice #12345” or “Payroll for October.”

- Signature: Finally, sign the check on the bottom-right corner. This is your authorization for the bank to release the payment. Without your signature, the check is invalid.

- Bank Account Information: This is pre-printed on your checks and includes your bank’s name, your account number, and the check number. You don’t need to fill this out, but it’s essential for processing payments.

Common Mistakes to Avoid When Writing a Check

While writing a check is a simple process, mistakes can happen. Here are a few things to watch out for:

- Incorrect Amounts: Double-check that both the numerical and written amounts match. If they don’t, the check could be returned or delayed.

- Missing Signature: Without your signature, the check will be considered invalid, even if all the other details are correct.

- Outdated Date: Using an old date may cause the check to be rejected, especially if it’s more than six months old.

- Incomplete Memo Line: Although the memo line is optional, leaving it blank can make it harder for both you and the payee to track the purpose of the payment.

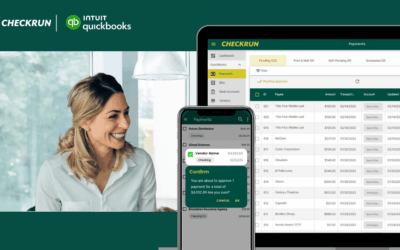

How Checkrun Can Help with QuickBooks Online

While writing a check by hand is simple, managing and processing checks in today’s business world requires efficiency, accuracy, and security. Checkrun, a leading online check writing software, takes the guesswork out of check writing and helps businesses like yours integrate seamlessly with QuickBooks Online. Here’s how Checkrun can transform the way you write and manage checks:

Seamless Integration with QuickBooks Online

If you’re already using QuickBooks Online, Checkrun makes it easy to send payments directly from your accounting system. You don’t need to manually transfer payment data from QuickBooks to your bank account. Instead, Checkrun syncs all payment information between the two platforms, saving you time and reducing errors.

Automatic Check Creation

Checkrun automatically generates checks based on the data you enter in QuickBooks. Whether you’re paying a vendor, employee, or contractor, the software ensures that all the details are accurate, including amounts, payee names, and memo entries. With Checkrun, you don’t have to worry about making mistakes when writing a check by hand.

Cloud-Based Check Writing

Checkrun is a cloud-based platform, meaning you can write and print checks from anywhere, at any time. Whether you’re at the office, at home, or on the go, you can access your QuickBooks data and issue checks directly through the Checkrun dashboard or mobile approval app. This level of accessibility makes Checkrun ideal for businesses with remote teams or multiple locations.

Payment Scheduling

With Checkrun, you can schedule payments in advance to ensure they’re sent out on time. This feature is especially useful for recurring payments like rent, utilities, or payroll. You can automate the payment process and avoid missing deadlines, all while staying compliant with your accounting practices.

Check Printing and Mailing

Checkrun handles the entire check writing process. Once the check is created, it can be printed directly from your device, or you can opt for Checkrun’s check mailing service, where they print and mail the check on your behalf. This service saves you time and ensures that your checks are mailed promptly, avoiding delays that could disrupt your business operations.

Enhanced Security Features

Security is critical when it comes to financial transactions. Checkrun uses encryption and other advanced security features to protect your sensitive payment data. Additionally, its integration with QuickBooks Online ensures that all payments are securely processed with minimal risk of fraud or error.

Detailed Reporting and Audit Trails

Checkrun provides detailed reports on all checks issued, making it easier to track payments and manage reconciliation. The audit trail feature allows you to see exactly when and where each check was issued, who signed it, and whether it has been cashed. This makes managing your finances more transparent and helps you stay prepared for audits.

Why Use Checkrun for QuickBooks Online?

When combined with QuickBooks Online, Checkrun offers a more streamlined, efficient, and secure way to manage your check writing process. It reduces the manual work involved in writing and tracking checks, allowing you to focus on your business instead of dealing with administrative tasks. Here’s why Checkrun is a must-have for QuickBooks users:

- Faster Payments: No more waiting for checks to be written manually—Checkrun automates the process.

- Better Financial Tracking: Integrated directly with QuickBooks, Checkrun ensures your books are always accurate and up-to-date.

- Increased Efficiency: Save time on repetitive tasks like printing and mailing checks.

- Greater Control: Schedule payments and access reports whenever you need them, ensuring you’re always on top of your finances.

Conclusion

Writing checks manually may be a simple task, but managing check payments efficiently requires modern solutions. By using Checkrun alongside QuickBooks Online, you can automate and simplify the check writing process, ensuring that your business stays organized, secure, and on track. With its user-friendly interface, cloud-based functionality, and seamless integration with QuickBooks, Checkrun offers a robust solution for businesses looking to streamline their financial operations.

If you’re ready to upgrade your payment system, Checkrun is the perfect tool to simplify check writing and help your business thrive.