Today, accounts payable teams are faced with various challenges– from working remotely and maintaining departmental efficiency, to keeping-up with technologies, managing cash flow, and making sure that payments are made and received on time in the most secure way possible.

A common question with many accounts payable professionals is: What’s the best way to pay? Let’s take a look at the various payment options available.

Paper Checks Aren’t Dead

Check payments have been around for centuries, with the first forms of check payments in the United States dating back to the 17th century. While checks require the sometimes tedious process of gathering approval signatures before printing, it is important to note that more than 50 percent of business payments are still made by check. Why? Paper Checks offer a tried and trusted workflow process where the payment is not valid until one or more authorized signatures are provided. Many business owners feel that checks provide them better cash flow controls than with electronic payments.

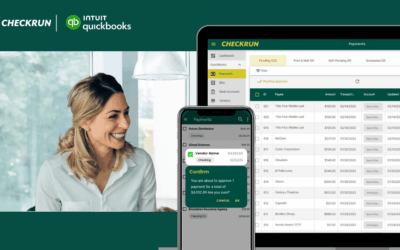

It is sometimes difficult to explain why checks remain so popular, especially in today’s business environment that finds many people working remotely, resulting in less face-to-face contact between accountants and their clients. Yet, new technology break-throughs have made checks the new payment of choice—again. Mobile applications now enable businesses to view payments and bills, secure approvals, schedule payments, and even to collect check signatures, all done remotely and right from our phones. Many companies are now opting for the service of printing and mailing of their checks in self-sealing envelopes. Modernized check payments have the advantages of traditional, same-day approval processes and cash flow management, combined with the paper-free benefits of electronic payments.

The Rising Star: Electronic Payments

Electronic checks (ACH) have their appeal, because of reduced paper use, less labor to process, and sometimes lower costs than alternative methods of payment. For many businesses, e-payments are a simple and comfortable process.

However, ACH payments have their drawbacks. ACH requires prefunding, so cash is tied-up for as long as 3-4 days before payments are actually due. Bank account information for the payee needs to be provided in advance of making any payment. ACH payments can also experience other delays. If the payee’s bank information is not collected and verified, then most electronic payments are converted to paper checks and processed 7 days later. ACH has been experiencing increasing rates of fraud (see discussion on fraud, below). A recent survey found that, of small businesses that still use paper checks, 42 percent of them stated that security concerns are the reason why they have not migrated to e-payments.

AP Card Payments

Another alternative for AP payments is the Virtual Card payment. There are many benefits to the issuer for using payment cards. One advantage is that the cost is either zero for them, or in some cases rewards are earned. Another attraction is that, like other credit card payments, virtual card payments come with a built-in float, and at times a credit to the issuer.

The main drawback to this virtual form of payment is that the advantages to the payor become disadvantages to the payee. For example, if the payee chooses to convert their payment into cash, they incur a cost for doing so. There is the hassle for the payee of having to process the card payment, or to make purchases with the card in order to actually use the payment. For these reasons, it is rare that a company can successfully convince all of their vendors to accept virtual card payments.

Fraud & Security: The bottom line

This is a complex subject on its own, but fraud is certainly one of the strongest considerations for companies moving from ACH to check payments. ACH requires that bank account information exists for both parties prior to a successful transaction. A very successful and common fraud scheme involving ACH and wire transfers is for a bad actor (criminal) to notify the paying company that the vendor’s bank account number has changed. This communication can come from a simple email, or a text message. The payor too often makes the ensuing payment successfully, and unfortunately to a fraudster’s bank account.

Check payments have a long history of combating check fraud and modern innovations now make it even more difficult for thieves to successfully modify or forge checks. It is much easier to accomplish ACH fraud, so that is where most criminals put their attention. Banks provide a very powerful fraud tool called Positive Pay in which banks will not pay presented checks unless they match exactly with payment data provided by the issuer.

A Combination of Payments

For many companies, using a combination of payment types is the best solution. Larger payments are traditionally best suited as payments by check. In addition to multiple layers of authentication, businesses can delay approving and issuing the payment until the same day the payment is due. With the modernization of checks, smaller payments can also be made to vendors that do not want to accept card payments or that have not provided banking information necessary for ACH payments.

The second level of payments can be via cards to vendors that will accept them. There are no costs and rewards might be available. These payments are typically smaller in value, and they can be made rapidly.

A third alternative is to use ACH for non-check payments, instead of card payments.

In the long-run, each payment mechanism has its advantages and disadvantages that can be considered by each business, depending on their needs and comfort levels.

The Pros and Cons of Payment Methods

Modernized Paper Check Pros:

- No pre-funding required

- Real time / same day approvals and release of payment

- Remittance data delivered as part of check

- Traditional approval processes via mobile apps, no paper needed

- Strong fraud tools

- Delays of mail system

- Accepted by all vendors

- Workflow controls

Modernized Paper Check Cons:

- Printing and mailing costs higher than ACH and card transaction fees

- Delays of mail system

- More labor intensive than e-payments

ACH Advantages:

- Less expensive transaction fee than check

- No paper required

ACH Drawbacks:

- Prefunding requirements

- Payee bank information collection required

- Lack of remittance data defining what the payment is for

- New targeted fraud attacks

- More expensive than AP Cards

AP Card payments Pros:

- No costs / some credits for paying by card

- Float payments or built-in credit

AP Card payment Cons:

- Limited acceptance by vendors

- Costs pushed to vendors who want cash

- Time to receive initial payments

There are many payment options available for businesses today. Do your research and find the best solution or solutions that fix your payment needs. Leveraging a check writing software like Checkrun, will allow you to access the most secure paper check solutions available today and includes print and mail services so all you need to do is approve the payment and we take it from there. If you are interested in learning more about Checkrun, click here for a free demo