Are your accounts payable processes feeling pretty complex? If so, you are not alone. A recent report suggests that many small businesses are struggling to maintain, let alone improve, their accounting functions. It can feel like it’s a constant tug-of-war but there are a few key tasks that can simplify accounts payable in your business, which will save you time and stress.

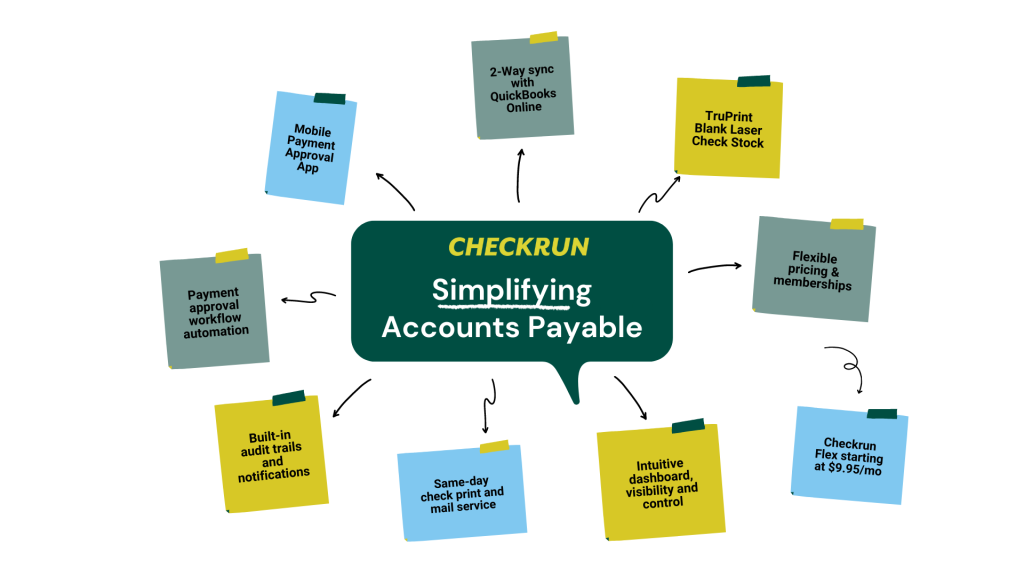

Checkrun makes it easy for you to pay bills online and to simplify your accounts payables. Process invoices from your mobile phone, send reminders to people who have not yet approved payments, and even print and mail payments for your clients – Checkrun simplifies these tasks and more. Here’s how:

1. Manage your payments from one place

Accounts payable is often one of the least-liked aspects of any business. Paying the bills, dealing with vendors, contracts, other paperwork — it can be a headache. Accounts payable software, like Checkrun, can help to simplify that process. It gathers all your accounts payable processes into one helpful location. Then, you can pay all your vendors in one place without worrying about missing a payment or forgetting to send one off.

You may have to track multiple payables and accounts, send out payments, chase-down payment approvals, obtain authorized signatures, and then reconcile those payments with your bank statements. It is time consuming to say the least. And remember we mentioned tracking? Well that could be a nightmare as well. There is no way that you will be able to easily account for every payment if you do not have a system in place. Thankfully, Checkrun can help you manage your accounts payable process from start to finish and from one place.

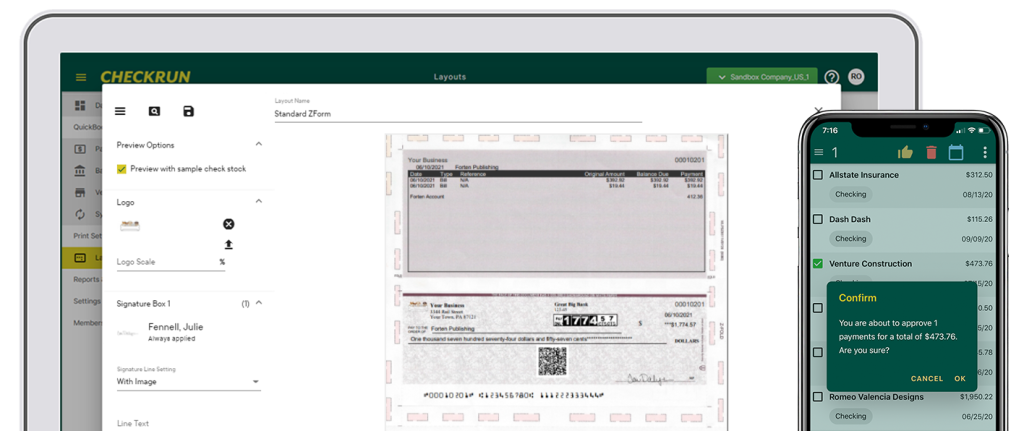

Checkrun’s simple dashboard and mobile approval app, predictive deadline tools, and efficient monitoring controls let you access all payment data in real-time, from anywhere. Say, “Good-bye!” to the pains of manual payment approvals, and “Hello!” to Checkrun’s simple, remote-enabled solution.

2. Approve and pay bills remotely

When check payments need to go out and everyone is working in different locations, tracking down approvers and obtaining necessary signature(s) on a check can be challenging. Checkrun simplifies the entire payment process by making it easier to approve and cut checks from any device. You will reduce the amount of time spent on finance tasks so you can spend less time in the office and more time in the field or working from home.

When using the Checkrun mobile app, you will be able to process payments and then send reminders to your accounts payable team, the payment approvers, and the authorized signers. You can also view payment details and transactions in real-time. Checkrun streamlines your operations to save your business hours each month to pay bills online. With the flexibility to authorize, sign, and to cut checks while working remotely, your payment processes will be more efficient, more secure, and far less costly.

3. Implement payment approval workflows

One of the most important aspects of a remote accounts payable (AP) team is accountability, especially with payments. It’s no secret that invoices can take weeks to approve — and that can be frustrating, not to mention costly. Some of the main reasons for delays include: manual processes, inconsistent approval process, and tracking down authorized approvers within your company when no one is in the office. If your business is struggling with getting payments approved and signed, it’s time for a new process.

With Checkrun, accountability is built into the system through customizable payment approval workflows and user roles. You can set up the approval workflows to match the ideal process for your organization and use notifications to ensure your team never misses a payment step. Roles are customized to allow you to set and limit access for each team member to ensure they can manage the necessary tasks while ensuring security, control and accountability. For example, an account administrator can easily add a new approver if someone is out-of-pocket (on vacation, out sick, unreachable, etc.). This flexibility keeps the payments approvals and signings moving… and that means payments go out on time..

4. Track your payments

One of the biggest causes of late payments is the accounts payable process. It is cumbersome and hard-to-track, and many small business owners rely on spreadsheets and manual workarounds to pay their vendors. At Checkrun, we take all of this out of your hand, so you can focus on what’s really important: your business and financial growth.

Checkrun lets you track the status of your payments from the moment they’re scheduled. All actions are tracked within Checkrun, along with who approved and signed each check, resulting in tighter internal controls that mitigate risk by eliminating the need for excess signers, signature stamps or signed blank checks. Tracking payments can help you better understand your cash flow status and make business decisions based on real-time information.

5. Focus more on your business and less on manual check printing

Every day, businesses of all sizes struggle with how to best handle their accounts payables workflow. Perhaps the most impactful way to get more work done remotely is to offload tasks wherever and whenever you can, such as utilizing an automated Print and Mail service that is a smarter, safer, cost-saving option.

Checkrun’s same-day Print and Mail Service transforms your paper-based process into a fully automated solution that dramatically reduces time and money spent on manual check writing and printing. Make and send check payments by phone, tablet, or computer from your office or home. The Print and Mail Service automates the entire process of generating and mailing check payments, so your business can focus on what matters most: growing revenue.

Conclusion

Managing accounts payable manually is a tedious, time-consuming and stressful task that takes a lot of time and often leads to unnecessary errors. Combine that with everyone working in different locations, it’s easy to see how tasks such as tracking down payment approvers and getting the right signature on a check can be challenging.

It doesn’t matter if you’re a small business or a large corporation, having a system for tracking and approving payments is critical. A simple and automated check payment process can be the difference between having control over your business and not.

For businesses of all sizes, Checkrun makes it easy to simplify and automate this process with a mobile-friendly app and easy online payment approval workflows. A better accounts payable process is a whole lot closer with Checkrun. You can get more done, with less hassle. Automate your cash flow and make sure your payments get paid securely and on time – every time.