If you are implementing Positive Pay because of a recent fraud occurrence or because you are at higher risk of check fraud, Checkrun’s positive pay file feature makes it easy to generate and export positive pay files that are formatted to your bank’s specifications. Whether you are using QuickBooks Pre-prints, Blank Check Stock or our Print and Mail service, a positive pay file can easily be generated within Checkrun and formatted to your bank’s positive pay specification.

Checkrun offers an extensive library of Positive Pay formats that work with almost any bank…seriously, we have over 200+ bank positive formats you can choose from. So, look no further and eliminate the hassles of positive pay file creation with Checkrun. Some of the key advantages:

- Simplify Positive Pay set up with your bank

- Easily print checks – then download the positive pay file for your bank

- Utilize over 200+ bank positive formats

- QuickBooks preprints and blank check stock supported

- Easy-to-use payment platform – never be locked into one payment type

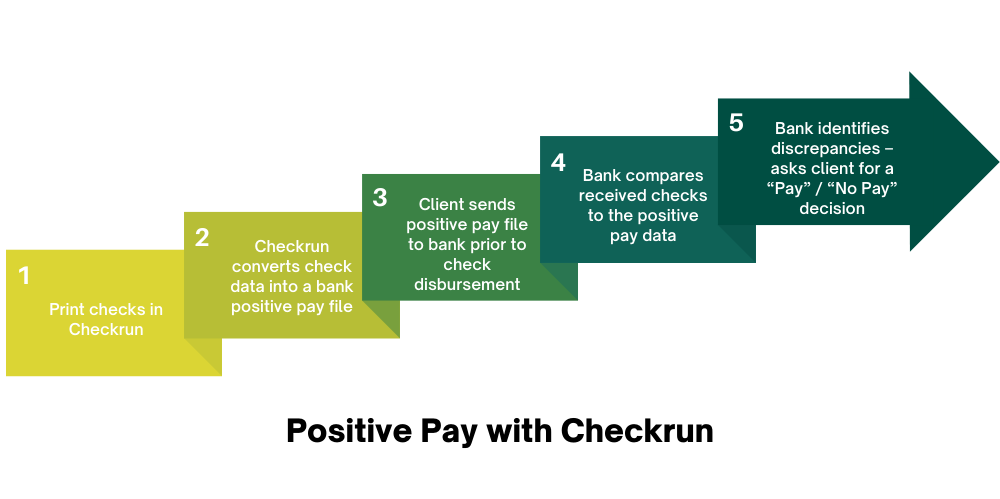

How does it work?

As soon as you print your checks within Checkrun, all of the check data – from QuickBooks Online – is captured. Checkrun instantly converts the data into your bank’s positive pay specification. You can easily export the files from Checkrun for transmission or upload them to your bank. The positive pay files include all of the pertinent details that the bank will use to protect your business from fraudulent activity and the risk of financial loss. We support two types of bank formats: Positive Pay File Conversion and Payee Positive Pay Compatible. Choose one or both, based on your bank’s requirements.

- Positive Pay File Conversion: As you issue checks, Checkrun converts them from a wide array of possible export formats into a single, positive pay format required by your bank.

- Payee Positive Pay Compatible: If your bank supports Payee Positive Pay, Checkrun can also generate positive pay files with the payee name for verification. The file includes a record of the date, amount, check number, account number, and payee name.

Built to combat check fraud before it happens

Positive Pay enables your business to stay one step ahead of criminals and protect your cash flow. Implementing strategies today to ensure protection in the future means less room for error. While every instance of fraud cannot be prevented, our positive pay file feature can dramatically minimize your risk and keep your finances safe.

Plus, when used together with high-security check stock, Positive Pay can dramatically reduce your businesses’ risk of fraudulent activity and payment fraud. Our TruPrint blank check stock adds over 20 advanced security features to your checks including: seQR code, security fonts, microprint and more.

Paying business bills can be a tedious and time-consuming task, especially if you have multiple payments to keep track of. It can be easy to miss a payment, forget a deadline, or accidentally approve a payment that is not verified. That’s why more and more finance teams are turning to online payment platforms and fraud protection systems like Checkrun to simplify their payment process and reduce the risk of payment fraud. Learn more about how Checkrun can help today.