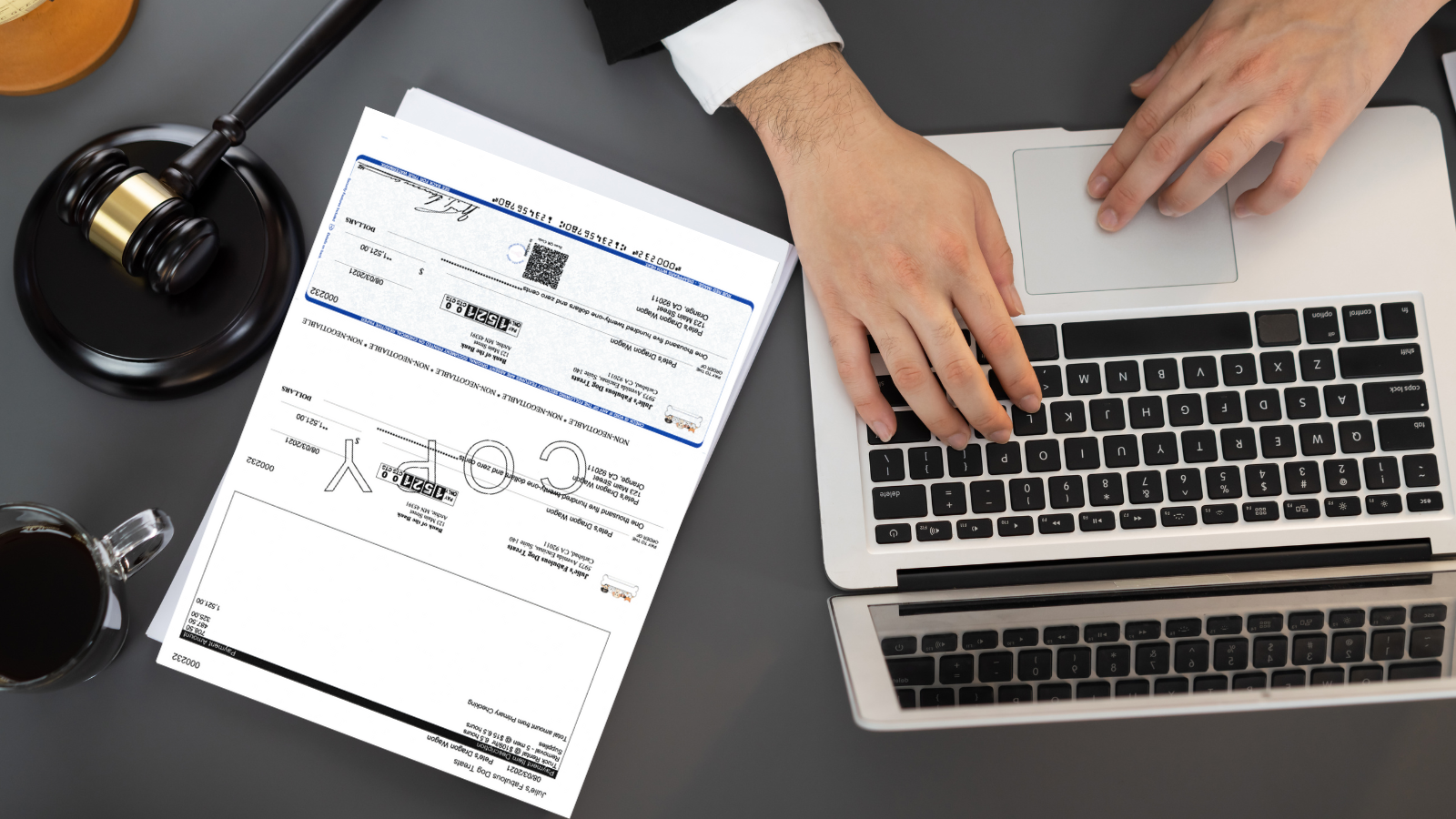

In a time where digital transactions and banking technology are prevalent, it’s worth considering why law firms continue to use traditional check payments for settlement checks, claims disbursement, and trust accounts. Although checks might seem old-fashioned to some, they are still commonly used in the legal industry for various reasons.

To understand why check payments continue to be used in law firms, it’s important to first grasp the nature of the transactions involved.

Settlement Checks

Settlement checks are payments provided by the defendant or their insurance company to the plaintiff in a legal settlement. These payments are typically intended to cover damages, medical costs, or other losses arising from a legal dispute or personal injury claim.

Claims Disbursement Checks

Law firms use these checks to distribute funds to different parties involved in a legal case, including clients, medical providers, or any other entities that are owed payments as part of a settlement or judgment.

Trust Accounts Check Payments

Law firms usually have trust accounts to manage client payments and funds, which are distributed according to the terms of a legal representation agreement, settlement, or court order. Funds from trust accounts are paid out via checks to clients, third-party service providers, or other beneficiaries.

Factors Contributing to the Ongoing Use of Check Payments in Law Firms

There are a number of reasons why check payments are commonly used in legal settlements, claims disbursement, and managing trust accounts. Here are a few:

- Legal Compliance and Record-Keeping: Even though electronic checks, fund transfers and credit card payments are becoming more common, many legal jurisdictions still require thorough documentation and record-keeping for all financial transactions, particularly those that involve client funds and settlements. Checks create a physical paper trail that can be important in case of an audit, dispute, or legal issue.

- Client Preferences: Some legal clients and legal professionals still prefer check payments, even with the rise of digital payment transactions. This choice might stem from worries about online security, data breaches, or a preference for traditional payment methods.

- Accessibility and Inclusivity: Checks can be a more inclusive payment option for clients who lack access to electronic banking or encounter challenges with digital transactions. This method ensures that everyone involved in a legal matter can receive and process payments effectively, regardless of their technological skills.

- Real-Time Funds Availability: Check payments can provide immediate access to funds upon deposit, unlike some electronic payment methods that may have processing delays or hold periods. This is particularly beneficial in urgent situations, like emergency disbursements or quick settlements.

Trends and Future Considerations

Law firms still use checks, but they’re also adopting new technologies to improve payment processes, such as online payment solutions. Many of these firms are looking into hybrid models that integrate traditional check payments with electronic methods like ACH transfers or digital wallets to provide more flexibility and efficiency in handling financial transactions.

Moreover, the ongoing evolution of banking and financial services is likely to impact the landscape of payment methods within the legal sector. Enhanced security features, digital authentication protocols, and the continued digitization of financial regulations may influence the gradual transition toward electronic payments while addressing the unique needs and considerations of legal professionals and their clients.

In summary, law firms continue to use check payments for settlement checks, claims disbursement, and trust accounts due to various regulatory, client-related, and practical reasons. Checks provide certain benefits regarding compliance, accessibility, and immediate access to funds, while legal professionals are also exploring new payment technologies to enhance efficiency and security in financial transactions.

Checkrun is changing check printing services for legal firms that use QuickBooks Online. Our mission is to simplify check printing for businesses of all sizes and industries. If your modern law firm wants to streamline its payment processes, consider Checkrun for secure online check printing. By using Checkrun’s modern solutions, law firms can concentrate on legal services like serving clients and winning cases. They can leave the complexities of check printing and mailing to the professionals. We are you legal check payment solution. Get started with Checkrun today!