With Covid-19 still affecting businesses, more and more accounting firms and small to mid-sized businesses are switching to remote work and online payment solutions. While working remotely is not uncommon, it often presents unknown challenges for those who have not yet invested in online payment services and technology. But there’s good news: doing so is easy, fast and cost-efficient.

To help you prepare your business, we huddled with some of our in-house experts and asked for their tips on the best ways to work from home as an accountant, bookkeeper, or as a small to mid-sized business. We’ve also added a few ways that Checkrun’s cloud-based payment management system can help your businesses in each section.

Move your payment data to a cloud-based system

If you haven’t already, now’s the time to set-up with a cloud-based accounting system like QuickBooks Online. Moving your accounting and business applications to QBO lets you access your payment data from any place that has an internet connection, including your own home.

Install Checkrun and the Mobile Approval App

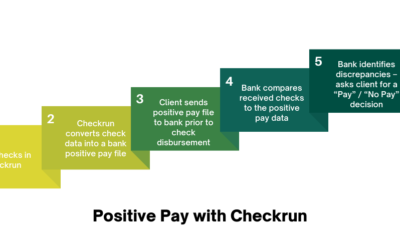

Checkrun extends QuickBooks Online through an API. That means no double entry of data for you. Payments are made directly from business accounts, so no pre-funding is required. Checkrun lets users review, approve and print bank-quality checks in minutes from anywhere, at any time. Checkrun checks can also be printed and mailed automatically or printed in company offices.

Manage your workflows and user roles

System access should be controlled through established user workflows that grant access permissions that – provide different users with various levels of permissions based on their role within the check printing process.

Checkrun gives you the ability to customize your workflows and role management capabilities to help tighten your internal controls. You can now mitigate additional risk by eliminating the need for excess signers, signature stamps or signed blank checks.

Print a more secure check

It’s important to use blank check stock (vs. pre-prints) which provides a higher-quality paper/toner bond. Blank check stock also contains high technology features developed to defend documents against chemical alteration, erasure, toner removal, photocopying and counterfeiting.

Set up notifications and reminders

Managing your payments should be engraved in the back of your mind. However, it is smart and helpful to have reminders and notifications in place, especially if you’re managing multiple accounts. Checkrun’s Mobile Approval App lets your stay on top of your workflow with auto-notifications. Our email and push notifications instantly let you know when your review, authorization or signature is needed.

Consider print and mail options

Checkrun checks can be printed and mailed automatically, or they may be printed in company offices. If you choose, skip self-printing altogether with Checkrun’s Print and Mail option. Whether it’s QuickBooks pre-prints or blank check stock, Checkrun accommodates multiple print layouts, colors, and logos so you can customize your checks to suit your needs.